Posted inBlockchain Tax Compliance

Comprehensive Guide: Crypto Margin Trading Loss Tax, Stablecoin IRS Reporting, and Crypto Tax Attorney Consultation

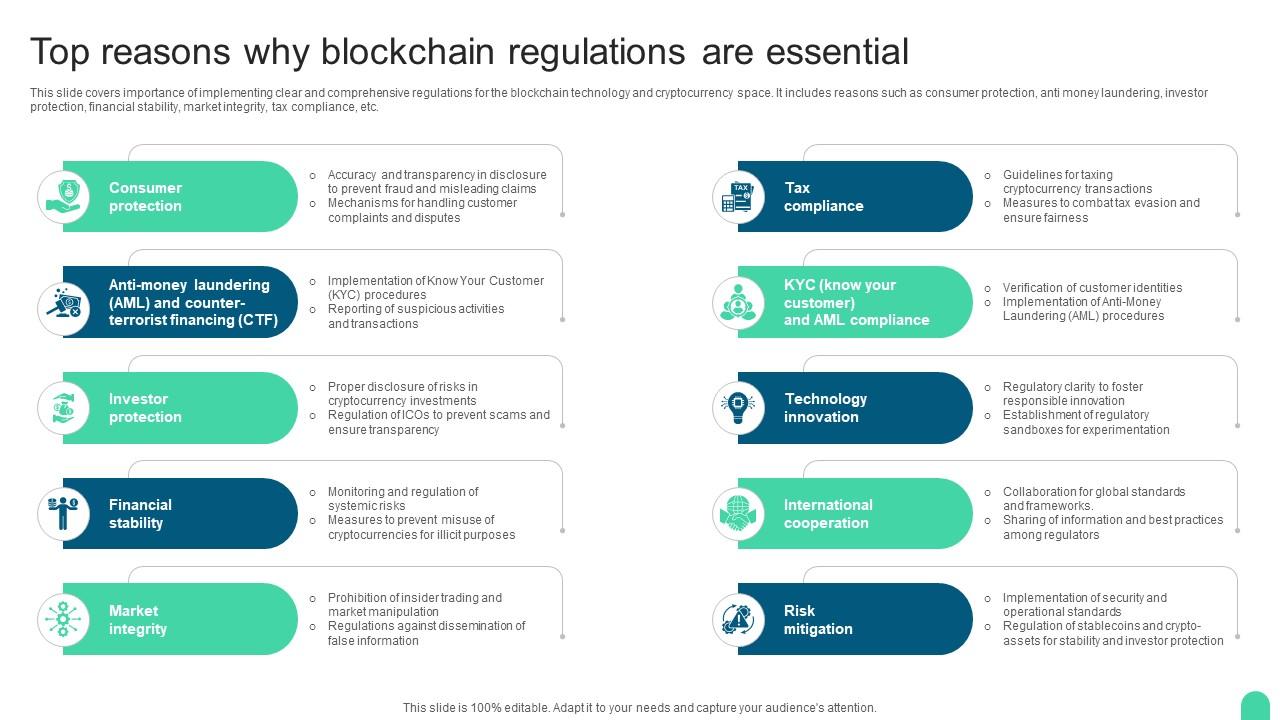

Confused about crypto taxes? Our comprehensive guide is your key to understanding crypto margin trading loss tax, stablecoin IRS reporting, and the benefits of a cryptocurrency tax attorney consultation. According…