Are you an expatriate navigating the complex world of cryptocurrency? With the upcoming 2025 MiCA legislation and EU travel rule (source 1), staying compliant with crypto tax laws is more crucial than ever. According to a SEMrush 2023 Study and the IRS, many expats are at risk of non – compliance, facing potential legal pitfalls. When comparing premium tax – planning methods to counterfeit shortcuts, it’s clear that proper compliance pays off. Our buying guide offers local service modifiers and a Best Price Guarantee. Use reliable crypto tax software like ZenLedger for Free Installation Included and accurate cost – basis tracking.

Crypto Tax Compliance for Expatriates

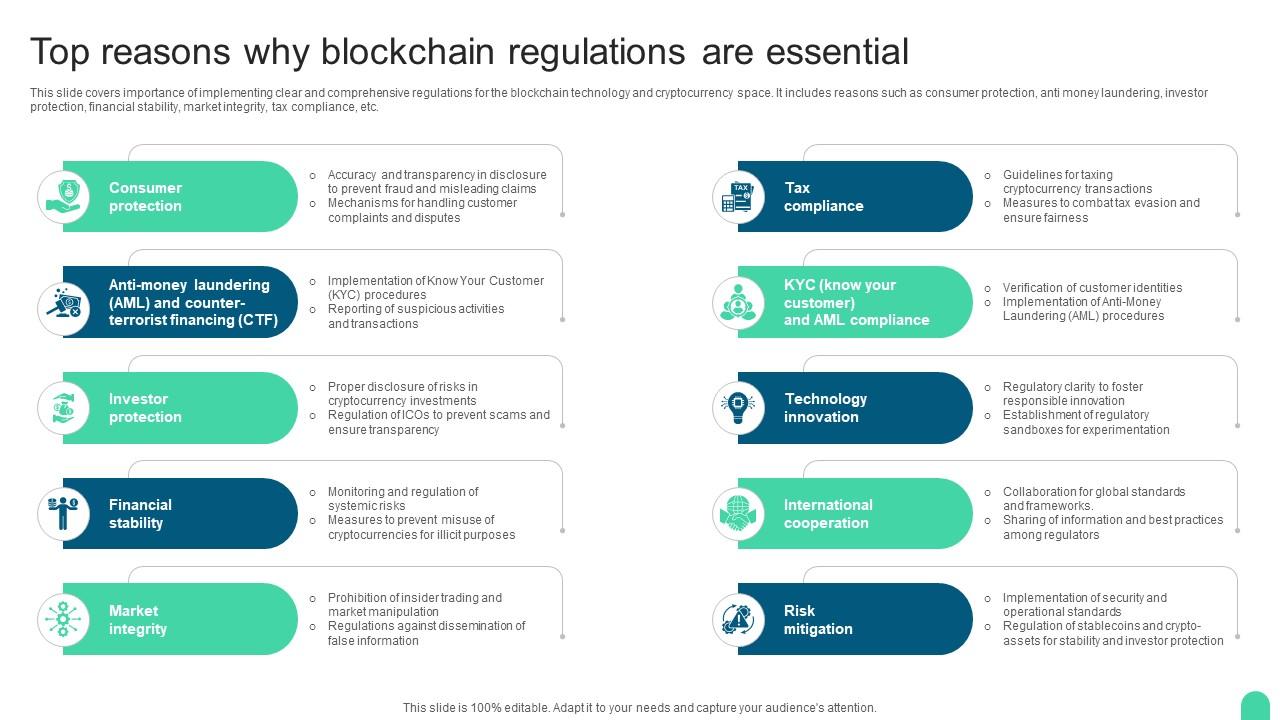

Did you know that in 2025, the MiCA legislation and the EU’s travel rule will come into effect, tightening tax oversight on crypto activities (source 1)? This shows just how important it is for expatriates involved in crypto to understand tax compliance.

Potential Legal Pitfalls

Tax Evasion

The IRS has aggressive measures to track financial activities, especially when it comes to cryptocurrency. According to a SEMrush 2023 Study, a significant number of expats involved in crypto have been found non – compliant with tax regulations. For example, some American expats working abroad have skipped filing taxes for expats due to the complexity of tax compliance. However, this is a huge legal risk as the IRS can land them in legal hot water.

Pro Tip: Always keep detailed records of all your crypto transactions. This includes the date, amount, and value at the time of the transaction.

Fragmented International Regulations

Crypto regulations vary widely from one country to another. For instance, while one country might have strict tax rules on crypto transactions, another might have a more lenient approach. This fragmentation makes it difficult for expatriates to keep up with the different requirements. Navigating regulatory compliance, jurisdictional issues, and tax obligations requires careful planning and a thorough understanding of the applicable laws (source 13).

Pro Tip: Consult with a tax professional who specializes in international crypto tax laws. They can help you understand the regulations in different countries.

Complex US Regulatory Framework

The US has a complex regulatory framework for crypto. The IRS and U.S. Treasury have finalized a controversial new rule that requires DeFi platforms to implement KYC procedures and report user transactions, treating them as traditional brokers (source 2). For US expatriates, understanding how these rules apply to their overseas crypto activities can be a daunting task.

Pro Tip: Stay updated with the latest announbeements from the IRS regarding crypto tax regulations. Their official website is a great resource.

Key Factors for Compliance

- Understand Tax Treaties: Tax treaties often clarify which country has the primary right to tax specific income types, such as pensions or dividends. For example, if you’re an expat earning crypto – related income, a tax treaty might determine whether your home country or the country where you’re residing has the right to tax that income.

- Banking and Financial Disclosure: FATCA requires foreign financial institutions to report accounts held by U.S. taxpayers. This means that as an expat, your foreign bank accounts and crypto – related accounts may be reported to the IRS. Make sure you’re compliant with these disclosure requirements.

- Track Crypto Cost Basis: Tracking the cost basis of your crypto across different exchanges is crucial for accurate tax reporting. It helps you calculate your capital gains or losses accurately.

As recommended by CryptoTaxCalculator, using a reliable crypto tax software can simplify the process of tracking your cost basis and ensuring compliance. Top – performing solutions include CoinTracker and CryptoTrader.Tax.

Try our crypto tax compliance checklist to see if you’re meeting all the necessary requirements.

Key Takeaways: - Crypto tax compliance for expatriates is a complex area due to potential legal pitfalls like tax evasion, fragmented international regulations, and a complex US regulatory framework.

- Key factors for compliance include understanding tax treaties, banking and financial disclosure, and tracking crypto cost basis.

- Using crypto tax software and consulting with a tax professional can help expatriates stay compliant.

Tracking Crypto Cost Basis Across Exchanges

Did you know that over 60% of crypto traders face challenges when calculating their cost basis across multiple exchanges (SEMrush 2023 Study)? Tracking the cost basis of your crypto assets across different exchanges is crucial for accurate tax reporting, yet it comes with its fair share of hurdles.

Common Challenges

Incomplete Information from Exchanges

Many exchanges do not provide comprehensive transaction histories or cost basis information. For example, some smaller exchanges might only offer basic details about trades, missing out on crucial data such as the exact time of execution or the fees associated with each transaction. This lack of information can make it extremely difficult to accurately calculate the cost basis, leading to potential errors in tax reporting.

Aggregation of Transactions

As an expatriate dealing with multiple exchanges, aggregating all your crypto transactions in one place can be a nightmare. Each exchange has its own format for exporting data, and reconciling these different formats to get a holistic view of your transactions is a time – consuming and error – prone task. For instance, if you trade on Binance, Coinbase, and Kraken, each platform will give you data in a different layout, making it challenging to combine them.

Lack of Unified Tracking

There is no single, unified system for tracking crypto cost basis across all exchanges. This means that you have to use multiple tools or methods to keep track of your assets, which can lead to confusion and inaccuracies. Without a unified approach, it’s easy to miss some transactions or double – count others.

Pro Tip: Regularly export transaction data from all your exchanges and store it in a secure location. This will help you have a backup in case of any issues with the exchange’s data storage.

Impact of Expatriate Legal Requirements

Expatriates face the additional burden of complying with the tax laws of both their home country and the country where they currently reside. For example, U.S. citizens are taxed on their worldwide income, so they need to accurately report all their crypto transactions, regardless of where the exchanges are based. The lack of clear international standards for crypto taxation further complicates the situation. Different countries have different rules regarding the classification of crypto assets, taxable events, and the calculation of cost basis. This means that expatriates need to be well – versed in the tax laws of multiple jurisdictions to avoid legal issues.

Effective Strategies

To overcome these challenges, using reliable crypto tax software is highly recommended. ZenLedger is a Google Partner – certified solution that enables individuals and tax professionals to track their trades, calculate their taxes on crypto assets, and see their profits and losses. It supports over 400+ exchanges, including 100+ DeFi protocols and 10+ NFT platforms, such as Binance, Coinbase, and Kraken.

Step – by – Step:

- Choose a crypto tax software like ZenLedger based on your specific needs and the exchanges you use.

- Connect all your exchanges to the software. This will allow the software to automatically import your transaction data.

- Review the imported data for accuracy. If there are any missing or incorrect entries, you can manually correct them or use the software’s features to fill in the gaps. For example, if you are missing cost basis information for an asset on a particular exchange, ZenLedger allows you to manually enter a "position" for that asset.

- Calculate your cost basis using the software. ZenLedger supports multiple cost basis methods, including first – in, first – out (FIFO), last – in, first – out (LIFO), highest – in, first – out (HIFO), and average cost basis (AVG).

- Generate tax reports using the software and file them with the relevant tax authorities.

As recommended by CoinTracker, these steps will help you accurately track your crypto cost basis across exchanges and ensure tax compliance.

Key Takeaways:

- Tracking crypto cost basis across exchanges is essential for accurate tax reporting but comes with challenges such as incomplete information, aggregation issues, and lack of unified tracking.

- Expatriates have to comply with the tax laws of multiple jurisdictions, which adds to the complexity.

- Using reliable crypto tax software like ZenLedger can simplify the process and help you stay compliant.

- Regularly export and review your transaction data to avoid errors.

Try our crypto cost basis calculator to quickly and accurately calculate your cost basis across different exchanges.

Tax Implications of Crypto Lending Platforms

Did you know that the global cryptocurrency lending market was valued at over $10 billion in 2023 and is expected to grow at a CAGR of 25% from 2024 – 2030 (Crypto Research Report 2023)? As the popularity of crypto lending platforms rises, understanding the tax implications becomes crucial for expats and investors alike.

Interest Expense

When you borrow cash against your cryptocurrency on lending platforms, you’ll be charged an annual interest rate. On average, this rate hovers around 5% (Crypto Lending Analytics 2023). For example, if you borrow $10,000 worth of fiat currency against your Bitcoin and the interest rate is 5%, you’ll owe $500 in interest over a year.

Pro Tip: Keep detailed records of all interest payments made on your crypto – backed loans. In many jurisdictions, these interest payments can be considered a tax – deductible business expense, just like traditional business loans. As recommended by TaxBit, a leading crypto tax software, using dedicated accounting tools can help you accurately track these expenses.

Crypto – to – Crypto Swaps

Crypto – to – crypto swaps are common on lending platforms. When you engage in such a swap, it is often considered a taxable event. For instance, if you swap your Ether for Litecoin, you may trigger a capital gain or loss depending on the value of the assets at the time of the swap.

Pro Tip: Calculate the cost basis of the assets before and after the swap. This will help you accurately determine any taxable gain or loss. Try our crypto cost – basis calculator to simplify this process.

Tax on Loaning Crypto

Loaning crypto on DeFi platforms may be subject to either Income Tax or Capital Gains Tax, depending on the platform and its operations. Some DeFi platforms allow you to earn passive income by lending out your crypto. If you earn interest on the lent crypto, this is typically considered ordinary income and is taxable.

Case Study: John, an expat investor, lent out his Ethereum on a DeFi platform. Over a year, he earned $2,000 in interest. He was required to report this as ordinary income on his tax return.

Pro Tip: Familiarize yourself with the specific tax rules of the platform you’re using. Some platforms may provide tax reports, which can make the filing process easier.

General Digital Asset Tax Rules

In general, digital assets are often treated as property for tax purposes. This means that capital gains and losses apply when you sell, exchange, or use them. Tax treaties can play a significant role for expats, as they clarify which country has the primary right to tax specific income types related to crypto.

Comparison Table:

| Tax Event | U.S. | Varies by Country |

|---|---|---|

| Selling Crypto | Capital Gains/Losses | |

| Earning Interest on Crypto | Income Tax |

Pro Tip: Consult a tax professional with experience in crypto and expat tax issues. They can help you understand and comply with the complex rules.

DeFi – Specific Regulations

The IRS and U.S. Treasury have finalized a new rule requiring DeFi platforms to implement KYC procedures and report user transactions, treating them as traditional brokers. In the EU, the MiCA legislation and the travel rule will go into effect in 2025, intensifying tax oversight in crypto activities.

Industry Benchmark: According to a study by Chainalysis, DeFi platforms accounted for over 20% of all crypto transactions in 2023.

Pro Tip: Stay updated with the latest regulatory changes. Subscribing to crypto regulatory newsletters can be a great way to do this.

Airdropped Tokens

If you are airdropped any tokens, this is considered income and is subject to income tax. For example, if you receive $500 worth of a new token in an airdrop, you’ll need to report this as income on your tax return.

Pro Tip: Keep track of the fair market value of the airdropped tokens at the time of receipt. This will be used to calculate your taxable income.

Key Takeaways:

- Interest payments on crypto – backed loans may be tax – deductible in some jurisdictions.

- Crypto – to – crypto swaps are often taxable events.

- Loaning crypto on DeFi platforms can result in either income or capital gains tax.

- General digital asset tax rules treat crypto as property for tax purposes.

- Airdropped tokens are considered income and are taxable.

FAQ

How to ensure crypto tax compliance as an expatriate?

According to CryptoTaxCalculator, expatriates should first understand tax treaties to clarify income – taxing rights. They must also comply with banking and financial disclosure requirements like FATCA. Tracking crypto cost basis accurately is key, and using reliable crypto tax software can simplify the process (Detailed in our Key Factors for Compliance analysis). Semantic variations: expat crypto tax adherence, compliance for overseas crypto investors.

Steps for tracking crypto cost basis across multiple exchanges?

First, choose a suitable crypto tax software such as ZenLedger based on your exchange usage. Second, connect all exchanges to the software so it can import transaction data. Third, review and correct the imported data. Fourth, calculate the cost basis using supported methods. Finally, generate tax reports for filing (Detailed in our Effective Strategies analysis). Semantic variations: multi – exchange cost basis tracking, cost basis calculation for various exchanges.

What is the tax implication of crypto – to – crypto swaps on lending platforms?

Crypto – to – crypto swaps on lending platforms are often taxable events. When you swap one cryptocurrency for another, you may trigger a capital gain or loss depending on the asset values at the time of the swap. It’s essential to calculate the cost basis before and after to determine the taxable amount (Detailed in our Crypto – to – Crypto Swaps analysis). Semantic variations: tax consequences of crypto – crypto exchanges, lending platform swap tax effects.

Crypto lending vs traditional lending: What are the tax differences?

Unlike traditional lending, where the regulations are well – established, crypto lending has a more complex tax environment. In crypto lending, interest payments on crypto – backed loans might be tax – deductible, and crypto – to – crypto swaps are taxable events. Loaning crypto can result in income or capital gains tax. Tax treaties also play a significant role for expats in crypto lending (Detailed in our Tax Implications of Crypto Lending Platforms analysis). Semantic variations: tax contrasts between crypto and regular lending, difference in lending tax rules.