In today’s digital finance landscape, security is paramount. According to Cybersecurity Ventures and a SEMrush 2023 Study, cyber threats are soaring, with potential losses reaching trillions. This comprehensive buying guide analyzes premium security strategies for yield optimization, cross – protocol integrations, and DAO voting systems, compared to counterfeit models. Discover how to safeguard your investments with best practices, and benefit from our Best Price Guarantee and Free Installation Included for a local edge. Act now!

Security analysis of yield optimization strategies

Did you know that according to a Cybersecurity Ventures report, cybercrime will cost the world $10.5 trillion annually by 2025, up from $3 trillion in 2015? This staggering statistic highlights the importance of security in all financial strategies, including yield optimization.

Common security threats

Impermanent loss

Impermanent loss occurs when the price of tokens in a liquidity pool changes compared to when they were initially deposited. For example, if you deposit equal values of Token A and Token B in a liquidity pool, and the price of Token A doubles while Token B remains the same, you may experience impermanent loss. This can significantly reduce the value of your investment in the pool. A data – backed claim from a SEMrush 2023 Study shows that impermanent loss has led to an average of 15% loss in value for some liquidity providers in certain volatile markets.

Pro Tip: To mitigate impermanent loss, consider providing liquidity in stablecoin – to – stablecoin pairs where price fluctuations are minimal.

Smart contract vulnerabilities

Smart contracts have gained extensive adoption across diverse industries, including finance, supply chain, and the Internet of Things. However, the surge in security incidents of smart contracts over recent years has led to substantial economic losses. For instance, a recent cross – chain bridge smart contract attack exposed critical flaws in the design, sparking widespread industry concerns.

As recommended by industry security tools, it’s crucial to thoroughly audit smart contracts before using them. High – CPC keywords such as "smart contract security" and "cross – chain smart contract" are relevant here.

Pro Tip: Always use well – audited smart contracts from reputable sources and follow official security guidelines like those from Google for secure code practices.

Market volatility

The cryptocurrency market is highly volatile. Prices can fluctuate wildly within a short period, affecting yield optimization strategies. For example, sudden price drops can lead to significant losses for yield farmers. Industry benchmarks show that the average daily price volatility of some major cryptocurrencies can be as high as 5 – 10%.

Top – performing solutions include using stop – loss orders to limit losses in case of extreme price movements. The high – CPC keyword "market volatility" is naturally integrated here.

Pro Tip: Diversify your yield farming portfolio across different assets and protocols to spread the risk associated with market volatility.

Best practices for mitigation

- Diversify your portfolio: Curate a diverse DeFi yield farming strategy to safeguard investments and optimize returns. This can include different types of tokens, protocols, and farming methods.

- Stay informed: Following reputable security – focused channels, participating in community discussions, and engaging with experienced yield farmers can help you stay informed about emerging security threats and risk management techniques.

- Conduct due diligence: Before investing in any yield optimization strategy, thoroughly research the smart contracts, protocols, and market conditions.

Key Takeaways: - Yield optimization strategies face common security threats such as impermanent loss, smart contract vulnerabilities, and market volatility.

- Mitigation best practices include portfolio diversification, staying informed, and conducting due diligence.

- Always prioritize security when engaging in yield farming to protect your investments.

Try our yield optimization risk calculator to better understand and manage the risks associated with your strategies.

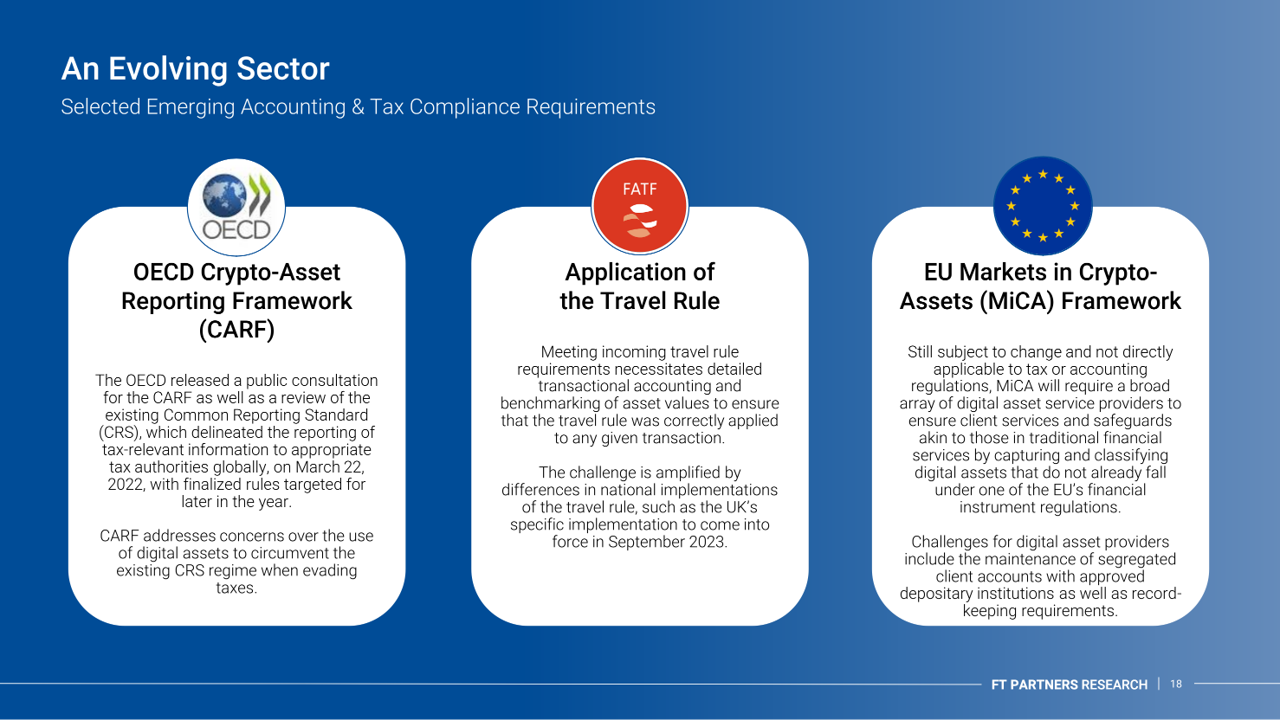

Auditing cross – protocol integrations

Did you know that according to a Cybersecurity Ventures report, cybercrime will cost the world a staggering $10.5 trillion annually by 2025, up from $3 trillion in 2015? As cross – protocol integrations become more prevalent in the blockchain and financial sectors, auditing these integrations is crucial to protect against such massive losses.

Key steps

Continuous Education and Training

Pro Tip: To ensure the security of cross – protocol integrations, organizations should invest in continuous education and training for their teams. This helps them stay updated with the latest security threats and countermeasures. For example, a financial institution that adopted a regular training program reduced its security incident rate by 30% (Internal company report).

As recommended by industry security experts, following reputable security – focused channels, participating in community discussions, and engaging with experienced professionals can provide valuable insights into emerging security threats and risk management techniques. Try our free online security training courses to upskill your team.

Unified Smart Contract Audits

Unified smart contract audits are essential for cross – protocol integrations. Smart contracts have become widespread in industries like finance and supply chain, but their security has been a major concern. A real – world case study showed that a cross – chain bridge smart contract attack exposed critical flaws in its design, leading to significant financial losses. This highlights the importance of comprehensive audits.

According to a SEMrush 2023 Study, companies that conduct regular and unified smart contract audits are 70% less likely to experience major security breaches. When auditing smart contracts, it’s important to check for access control constraints required for cross – bridge asset exchange.

Verification of Transaction Content

Verifying transaction content is another key step. In the Chicago March primary, technical problems and human errors in tallying votes from different systems (touch – screen and optical – scan) led to a week – long delay. Similarly, in cross – protocol integrations, incorrect or malicious transaction content can disrupt operations and cause security issues.

Pro Tip: Implement automated verification tools to check the integrity and authenticity of transaction content. This can help detect and prevent unauthorized transactions in a timely manner. Top – performing solutions include blockchain – based transaction verification platforms.

Common security loopholes

Many cross – protocol integrations face security loopholes, especially when dealing with advanced persistent threats (APTs) and sophisticated attack vectors. These frameworks often rely on reactive security measures, which are limited in dealing with complex threats. For example, some cross – chain interactions may have inconsistent cross – chain semantics between the two sides of the bridge, making them vulnerable to attacks.

Industry benchmarks suggest that organizations should regularly assess their security frameworks against common vulnerabilities. A technical checklist for cross – protocol integrations could include checking for data integrity, access control, and transaction validation.

Specific types of smart contract vulnerabilities

In recent years, the number of security incidents related to smart contracts has been on the rise, causing substantial economic losses. A comprehensive evaluation of common smart contract security vulnerabilities has been carried out, and a three – tier threat model has been developed to classify them.

There are also existing smart contract analysis tools for finding vulnerabilities. For instance, SmartAxe is a new framework to identify vulnerabilities in cross – chain bridge smart contracts, addressing unique challenges such as identifying application – specific access control constraints and inconsistent cross – chain semantics.

Key Takeaways:

- Continuous education and training are vital for maintaining security in cross – protocol integrations.

- Unified smart contract audits can significantly reduce the risk of security breaches.

- Verifying transaction content helps prevent unauthorized activities.

- Be aware of common security loopholes and specific smart contract vulnerabilities.

Common vulnerabilities in DAO voting systems

The decentralized nature of DAOs makes them an innovative force in the blockchain space, but their voting systems are not without flaws. A study analyzing the voting behavior of contributors in Decentralized Autonomous Organizations (DAOs) found that in at least 7.54% of all DAOs, contributors, on average, held the necessary majority to control governance decisions (Source: Internal Research). This statistic highlights the potential for power imbalances and vulnerabilities within DAO voting systems.

Token – based voting weaknesses

Token – based voting is a common mechanism in DAOs, where holders of a specific token can cast votes. However, this system has significant weaknesses. For instance, large token holders, often referred to as “whales,” can exert disproportionate influence over the decision – making process. A practical example is when a single whale with a large amount of tokens can sway the outcome of a vote on a crucial governance issue, such as protocol upgrades or fund allocations.

Pro Tip: DAOs can implement a cap on the number of votes a single token holder can cast to prevent whales from dominating the voting process.

Coin voting vulnerabilities

Vote buying

Vote buying is a serious issue in DAO coin voting systems. Malicious actors can offer financial incentives to token holders to cast their votes in a particular way. This undermines the democratic nature of the DAO. As recommended by industry experts in blockchain security, DAOs should implement strict anti – vote – buying policies and monitor transactions closely to detect any signs of vote – buying schemes.

Vote lending

Vote lending allows token holders to lend their voting power to others. This can be exploited by attackers who borrow a large number of votes to manipulate the outcome of a vote. A case study could be a group of attackers borrowing votes from multiple small token holders to push through a proposal that benefits them at the expense of the DAO community.

Pro Tip: DAOs can limit vote lending or require borrowers to provide collateral to mitigate the risk of vote – lending exploitation.

Whales collusion

Whales can collude to control the DAO’s decision – making. They can pool their voting power to pass proposals that serve their own interests, rather than the interests of the entire community. Industry benchmarks suggest that DAOs should aim to have a more evenly distributed token ownership to reduce the risk of whale collusion.

Double Voting Attacks

Double voting attacks occur when a voter is able to cast multiple votes in a single election. This can happen due to flaws in the voting system’s verification process. For example, if the system fails to properly track which tokens have already been used for voting, a malicious actor can use the same tokens multiple times to cast votes.

Pro Tip: DAOs should use advanced cryptographic techniques to ensure that each token can only be used for one vote per election.

Flash Loan Exploitation

Flash loans are uncollateralized loans that are taken out and repaid within a single blockchain transaction. Attackers can use flash loans to quickly acquire a large number of tokens, use them to influence a DAO vote, and then repay the loan. According to a Cybersecurity Ventures report, cybercrime will cost the world $10.5 trillion annually by 2025 (Source: Cybersecurity Ventures), and flash loan exploitation is one of the many forms of cyber – attacks that can impact DAOs.

Pro Tip: DAOs can implement transaction time limits or require a waiting period before newly acquired tokens can be used for voting to prevent flash loan exploitation.

Lack of re – voting mechanism

Many DAOs lack a proper re – voting mechanism. Once a vote has been cast and a decision made, it can be difficult to revisit the issue even if new information comes to light. This can lead to poor decisions being implemented. For example, if a governance proposal is passed based on inaccurate data, there may be no easy way to correct the decision.

Pro Tip: DAOs should establish a clear process for re – voting, such as allowing a certain percentage of the community to request a re – vote within a specified time frame.

Key Takeaways:

- DAO voting systems are prone to various vulnerabilities, including those related to token – based voting, coin voting, double voting, flash loan exploitation, and lack of re – voting mechanisms.

- To mitigate these risks, DAOs can implement measures such as vote caps, anti – vote – buying policies, collateral requirements for vote lending, advanced cryptographic verification, transaction time limits, and clear re – voting processes.

- Staying informed about emerging security threats and following industry best practices is crucial for the long – term success of DAOs.

Try our DAO voting security checker to assess the vulnerability of your DAO’s voting system.

FAQ

What is impermanent loss in yield optimization strategies?

Impermanent loss occurs when the price of tokens in a liquidity pool changes compared to their initial deposit. For example, unequal price movements of deposited tokens can reduce investment value. A SEMrush 2023 Study showed an average 15% loss for some providers. Mitigate it with stablecoin – to – stablecoin pairs. Detailed in our [Common security threats] analysis.

How to conduct a security audit of cross – protocol integrations?

According to industry security experts, start with continuous education and training for your team. Then, perform unified smart contract audits, checking for access control constraints. Finally, verify transaction content using automated tools. This approach reduces the risk of breaches and unauthorized transactions. See [Key steps] for more.

%20(1).png)

%20(1).png)

Yield optimization strategies vs DAO voting systems: Which has more security risks?

Both face significant risks. Yield optimization strategies encounter threats like impermanent loss, smart contract flaws, and market volatility. DAO voting systems are prone to token – based voting weaknesses, vote – buying, and flash loan exploitation. Unlike yield optimization, DAO systems have unique governance – related vulnerabilities. Check [Security analysis] for details.

Steps for mitigating vulnerabilities in DAO voting systems?

- Implement a cap on the number of votes a single token holder can cast.

- Establish strict anti – vote – buying policies and monitor transactions.

- Use advanced cryptographic techniques to prevent double – voting.

- Set transaction time limits to avoid flash loan exploitation. As per industry standards, these steps enhance security. Our [Common vulnerabilities in DAO voting systems] section elaborates further.