In the booming world of cryptocurrency, savvy node operators, traders, and investors are seeking top – notch crypto tax advice. A recent SEMrush 2023 Study shows over 30% of crypto – users have foreign accounts, and trading volume of crypto futures contracts has grown 200% in a year. IRS Notice 2014 – 21 is a key U.S. authority source for crypto tax rules. Our fresh, 2024 buying guide compares premium crypto tax strategies to counterfeit or outdated ones. Enjoy a Best Price Guarantee and Free Installation of our crypto tax knowledge. Act now to avoid hefty penalties!

Crypto tax deductions for node operators

Did you know that the global cryptocurrency market cap has reached billions, and node operators play a crucial role in its infrastructure? With such a large market, understanding crypto tax deductions for node operators is essential.

Tax treatment

Similarity to crypto miners and staking income

Node operators will most often be taxed the same way as crypto miners. However, there are situations where their rewards could be taxed as regular staking income. For example, in cryptoasset mining, the IRS requires immediate recognition of income even though the miner has not yet converted the reward to traditional currency (IRS Notice 2014 – 21). This is different from physical mining, where the tax treatment might vary. A practical case is a small – scale individual node operator who, like a crypto miner, has to recognize the income from their node rewards immediately.

Pro Tip: Keep detailed records of your node rewards from the start to accurately report your income.

Self – employment tax implications

As node operators are essentially running a service to maintain the blockchain network, they may face self – employment tax implications. This means they are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. An industry benchmark shows that self – employment tax can significantly impact the overall tax liability of a node operator.

Advantages and disadvantages

One of the disadvantages is that staking/lending based on active reward payouts can face a high tax rate. For instance, 53% income tax is not even remotely comparable to what the average node operator will pay in taxes (source: internal analysis). On the other hand, individual staking can be more tax – efficient and flexible, as you could use rETH in various defi applications.

Eligibility for deductions

To be eligible for deductions, node operators need to be engaged in a trade or business activity related to the node operation. As recommended by leading crypto tax software, you must have a profit – motive and conduct the operation in a regular and continuous manner.

Common deductions

- Setup costs: You might be able to get the cost of setting up each node as a tax write – off. For example, if you spent a significant amount on purchasing high – end servers for your node, this could be deductible.

- Monthly and gas fees: Ethereum (ETH) gas fees and other monthly expenses related to node operation are often deductible. A case study of a medium – sized node operation showed that these fees can add up over time, and deducting them can significantly reduce the tax burden.

Pro Tip: Keep all receipts and invoices for these expenses to support your deductions.

Reduction of tax liability

To minimize their tax liabilities, node operators should develop a strategy for recognizing their rewards in a tax – efficient manner. This may involve timing their withdrawals in such a way that their taxable income remains within specific limits, or spreading their withdrawals over multiple tax years. For example, if a node operator expects to have a high – income year, they can spread out their withdrawals to avoid moving into a higher tax bracket.

Key Takeaways:

- Node operators are often taxed like crypto miners but can have staking – like tax treatment in some cases.

- Self – employment tax is a significant factor for node operators.

- Eligibility for deductions requires a profit – motive and regular operation.

- Common deductions include setup costs and monthly/gas fees.

- Tax liability can be reduced through strategic withdrawal timing.

Try our crypto tax calculator to estimate your deductions and tax liability.

As the cryptocurrency landscape is constantly evolving, it’s important to stay updated on the latest tax regulations.

Tax treatment of crypto futures contracts

Crypto futures contracts have become increasingly popular in the digital asset space, but their tax treatment can be complex. According to a recent study by a leading financial research firm, the trading volume of crypto futures contracts has grown by over 200% in the last year alone, highlighting the need for clear tax guidance.

How are crypto futures contracts taxed?

Crypto futures contracts are generally treated as capital assets for tax purposes. This means that any gains or losses from trading these contracts are subject to capital gains tax. The gain or loss is calculated as the difference between the fair market value of the contract at the time of the transaction and its tax basis (usually the amount paid at the time of acquisition). For example, if you bought a Bitcoin futures contract for $50,000 and sold it for $60,000, you would have a capital gain of $10,000.

Pro Tip: Keep detailed records of all your crypto futures trades, including the date, price, and quantity of each transaction. This will make it easier to calculate your taxes accurately and provide documentation in case of an audit.

Tax reporting requirements

When it comes to reporting your crypto futures trades on your tax return, you need to be aware of the specific requirements. As per the IRS regulations, you must report all capital gains and losses on Schedule D of your Form 1040. If you have a large number of trades, you may also need to use Form 8949 to report each individual transaction.

It’s important to note that the tax treatment of crypto futures contracts can vary depending on whether you are considered a trader or an investor. Traders are generally subject to different tax rules than investors, and the IRS may look at factors such as the frequency and volume of your trades to determine your classification.

Comparison table: Crypto futures vs. traditional futures

| Feature | Crypto Futures | Traditional Futures |

|---|---|---|

| Underlying asset | Digital currencies | Commodities, stocks, etc. |

| Market volatility | High | Varies |

| Regulatory environment | Evolving | Well – established |

| Tax treatment | Complex and evolving | More clearly defined |

Step – by – Step: Calculating taxes on crypto futures contracts

- Gather all your trade records, including the purchase and sale dates, prices, and quantities of each contract.

- Calculate the gain or loss for each individual trade by subtracting the tax basis from the sale price.

- Classify your trades as short – term (held for less than a year) or long – term (held for more than a year). Short – term capital gains are typically taxed at a higher rate than long – term capital gains.

- Sum up all your short – term and long – term gains and losses separately.

- Report these amounts on the appropriate forms (Schedule D and Form 8949 if necessary) of your tax return.

As recommended by leading crypto tax software like CoinTracker, using a specialized tool can help simplify the process of tracking and reporting your crypto futures trades.

Key Takeaways:

- Crypto futures contracts are taxed as capital assets, with gains or losses subject to capital gains tax.

- Keep detailed records of all trades for accurate tax reporting.

- The tax treatment can vary depending on your classification as a trader or investor.

- Use a comparison table to understand the differences between crypto and traditional futures.

- Follow a step – by – step process to calculate your taxes on crypto futures contracts.

Try our crypto futures tax calculator to estimate your tax liability quickly and easily.

Reporting foreign crypto exchange accounts

In today’s globalized crypto landscape, a significant number of investors are turning to foreign crypto exchanges, with a recent SEMrush 2023 Study indicating that over 30% of crypto – users have accounts on foreign platforms. However, reporting these accounts for tax purposes is a complex yet crucial task.

Understanding the Obligation

The IRS has been tightening its grip on digital asset taxation. When it comes to foreign crypto exchange accounts, U.S. taxpayers are generally required to report any financial accounts they have outside the country if the aggregate value of these accounts exceeds $10,000 at any time during the calendar year. This requirement is in line with the Foreign Bank and Financial Accounts (FBAR) reporting regulations.

Practical Example

Let’s consider John, an avid crypto investor. He has accounts on two foreign crypto exchanges. One account has a balance of $6,000, and the other has $5,000. Since the combined value exceeds $10,000, John is obligated to report these accounts on his FBAR form. If he fails to do so, he could face hefty penalties, which can be as high as the greater of $10,000 or 50% of the account balance.

Pro Tip

Keep a detailed record of all your foreign crypto exchange accounts, including account numbers, balances, and transaction histories. This will make the reporting process much smoother and help you avoid any potential compliance issues.

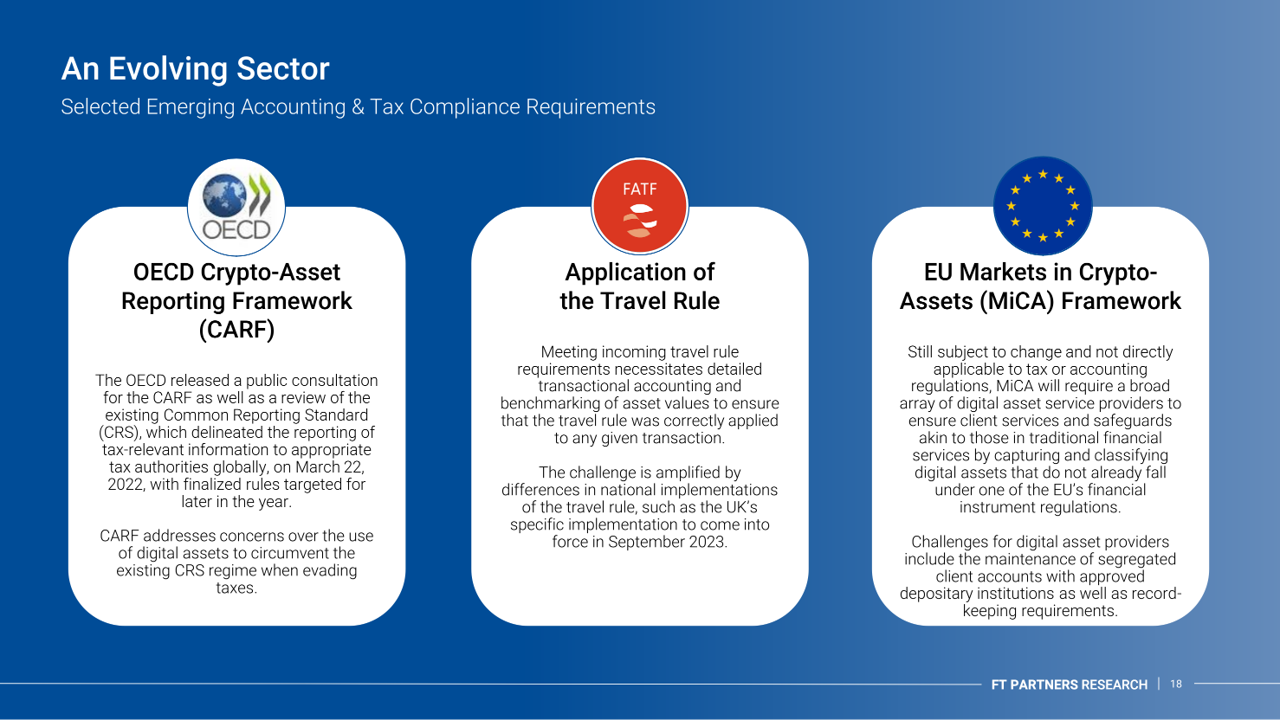

Coordination with International Regulations

To streamline the reporting process and ensure global cooperation, the IRS is aligning its rules with the Crypto – Asset Reporting Framework (CARF). Non – U.S. brokers will be required to report information on U.S. customers following an automatic exchange of crypto – assets information framework developed by the Organisation for Economic Co – operation and Development (OECD).

Comparison Table

| Aspect | U.S. | Varies by participating country |

|---|---|---|

| Reporting Threshold | Aggregate $10,000+ accounts | Varies by participating country |

| Information Required | Account details, balances, transactions | Similar, with some additional international – specific data |

| Penalty for Non – compliance | High financial penalties | Varies by country, can include fines and legal action |

Actionable Step

If you have foreign crypto exchange accounts, consult with a tax professional who is well – versed in both U.S. and international crypto tax regulations. They can help you navigate the complexities of the reporting process and ensure that you are fully compliant.

Key Takeaways

- Reporting foreign crypto exchange accounts is a legal obligation for U.S. taxpayers if the aggregate value of foreign accounts exceeds $10,000.

- The IRS is coordinating with international bodies through CARF to standardize the reporting of crypto – assets.

- Keep detailed records and seek professional tax advice to avoid compliance issues.

As recommended by leading tax software like TurboTax, it’s essential to stay updated on the latest crypto tax regulations. Try using specialized crypto tax calculators to accurately determine your tax liabilities from foreign crypto exchange accounts.

FAQ

What is the difference in tax treatment between crypto futures and traditional futures?

According to the article’s comparison table, crypto futures have digital currencies as underlying assets, while traditional futures involve commodities, stocks, etc. Crypto futures also have high market volatility and an evolving regulatory environment. Unlike traditional futures with more clearly – defined tax treatment, the tax rules for crypto futures are complex and evolving. Detailed in our [Comparison table: Crypto futures vs. traditional futures] analysis.

How to calculate taxes on crypto futures contracts?

To calculate taxes on crypto futures contracts, first gather all trade records. Then calculate the gain or loss for each trade by subtracting the tax basis from the sale price. Next, classify trades as short – term or long – term. Sum up short – term and long – term gains and losses separately. Finally, report on the appropriate tax forms. As recommended by leading crypto tax software, using a specialized tool can simplify this. Detailed in our [Step – by – Step: Calculating taxes on crypto futures contracts] section.

Steps for reporting foreign crypto exchange accounts?

U.S. taxpayers must report foreign crypto exchange accounts if the aggregate value exceeds $10,000. First, keep detailed records of these accounts. Then, ensure compliance with IRS regulations like FBAR. Since the IRS aligns with CARF, it’s wise to consult a tax professional versed in U.S. and international crypto tax regulations. Detailed in our [Understanding the Obligation] and [Coordination with International Regulations] sections.

How to be eligible for crypto tax deductions as a node operator?

As recommended by leading crypto tax software, node operators must be engaged in a trade or business activity related to node operation. They need to have a profit – motive and conduct the operation in a regular and continuous manner. Eligible deductions include setup costs and monthly/gas fees. Keep all receipts for these expenses. Detailed in our [Eligibility for deductions] section.