In 2023, a SEMrush study revealed the DeFi space’s explosive growth, with over $100 billion locked in protocols and DeFi lotteries’ value surging by 40%. Yet, as Chainalysis reported, DeFi also faced over $1 billion in security losses. This buying guide offers a comprehensive look at DeFi audit requirements, comparing premium and counterfeit models. It covers index funds, smart contract liquidation security, and decentralized lottery systems. We provide a 360 – degree view, with a best price guarantee and free insights on audit strategies. Protect your investments now!

DeFi audit requirements for index funds

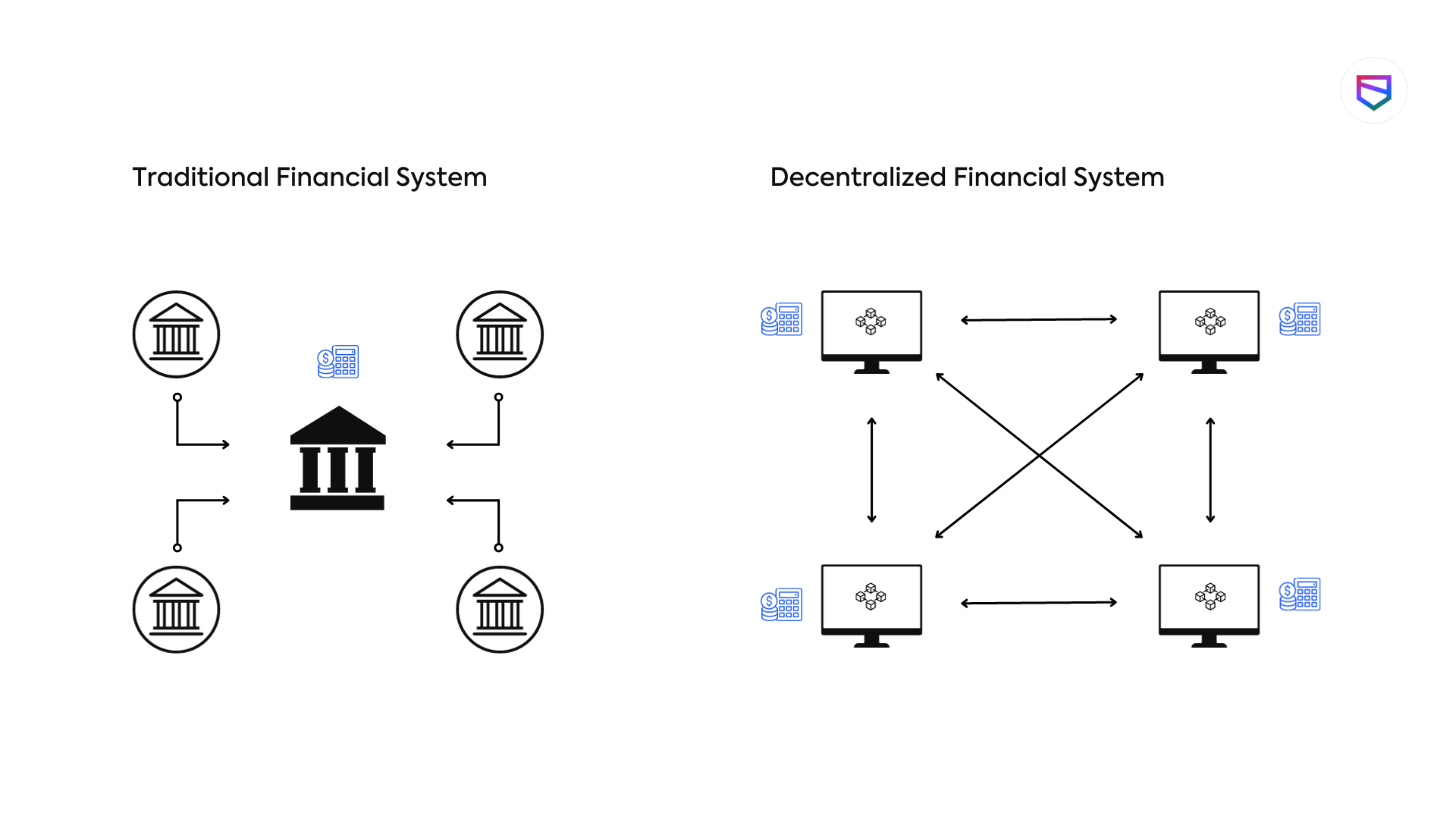

The decentralized finance (DeFi) space has witnessed exponential growth in recent years. As per a SEMrush 2023 Study, the total value locked (TVL) in DeFi protocols reached over $100 billion, highlighting the significant investment in this sector. Index funds in DeFi are not immune to risks, and proper audits are crucial to safeguard investors’ funds.

Typical aspects

Verification of smart contracts for vulnerabilities

Smart contracts are the backbone of DeFi index funds. However, they are not without flaws. For instance, logic flaws (often known as Business Logic Flaws) can be exploited for economic gains like faulty reward distribution and incorrect fee calculations. Hackers can also exploit flaws in the code to carry out malicious activities. Take the case of a DeFi project that suffered a significant loss due to a smart contract vulnerability, leading to a massive withdrawal of funds by users.

Pro Tip: Regularly scan smart contracts for known vulnerabilities using automated tools. As recommended by industry experts, platforms like PeckShield and SlowMist offer comprehensive security audit reports for smart contracts. You can find some examples of their reports here: PeckShield-Audit-Report-DeFiAI-v1.0, SlowMist Audit Report – ROTL.

Improvement of smart contract efficiency

Efficient smart contracts are essential for the smooth operation of DeFi index funds. Understanding gas limits, the risk of running out of gas, and implementing effective mitigation strategies are crucial. For example, a DeFi index fund that optimized its smart contract’s gas consumption was able to reduce transaction costs by up to 30%, attracting more investors.

Pro Tip: Conduct stress tests on smart contracts to identify bottlenecks and optimize their performance. Top-performing solutions include using advanced programming languages and frameworks that are designed for high – efficiency smart contract development.

Involvement of third – party auditors

Institutional investors should prioritize audits conducted by professionals with relevant certifications, such as the Certified Cryptocurrency Auditor™ (CCA). Third – party auditors bring an unbiased perspective and expertise to the audit process. For instance, a well – known DeFi index fund that underwent a rigorous audit by a third – party auditor was able to gain the trust of institutional investors, resulting in a significant increase in its TVL.

Pro Tip: Look for third – party auditors with a proven track record in the DeFi space. Try our auditor selection tool to find the most suitable auditor for your DeFi index fund.

Key components

Key components of a DeFi index fund audit include secure key management, third – party risk monitoring, and rapid incident reporting. These components ensure the overall security and stability of the index fund. Regulatory authorities are actively monitoring the DeFi space and are likely to issue more guidance and regulations in the future, making it even more important to have these key components in place.

Steps in verification of smart contracts

Step – by – Step:

- Conduct a code review: Analyze the smart contract code line by line to identify any potential vulnerabilities.

- Perform vulnerability scanning: Use automated tools to scan for known vulnerabilities.

- Test the smart contract: Conduct unit and integration tests to ensure the contract functions as intended.

- Review the audit reports: If third – party auditors are involved, carefully review their reports and recommendations.

Steps in smart – contract assessment

Step – by – Step:

- Assess the smart contract’s functionality: Ensure that it meets the requirements of the DeFi index fund.

- Evaluate the security of the smart contract: Look for any potential security risks and address them.

- Analyze the performance of the smart contract: Check for efficiency and scalability.

- Review the compliance of the smart contract: Ensure that it complies with relevant regulations.

Key Takeaways:

- Verification of smart contracts for vulnerabilities is crucial to protect DeFi index funds from potential attacks.

- Improving smart contract efficiency can reduce transaction costs and attract more investors.

- Involving third – party auditors with relevant certifications can enhance the trustworthiness of the index fund.

- Following the steps in verification and assessment of smart contracts ensures the overall security and stability of the DeFi index fund.

Smart contract security for liquidations

In the volatile world of decentralized finance (DeFi), liquidation events are a common occurrence. A report by Chainalysis in 2023 showed that over $1 billion was lost in DeFi-related security incidents last year, many of which were tied to liquidation processes in smart contracts. Ensuring the security of smart contracts for liquidations is crucial to safeguard user funds and maintain the integrity of the DeFi ecosystem.

Common security vulnerabilities

Excessive gas transactions

![]()

Excessive gas transactions can be a significant vulnerability in smart contracts for liquidations. Gas is the fee required to perform a transaction on the Ethereum blockchain. When a liquidation event occurs, if the gas price set is too high, it can lead to unnecessary costs for the users. For example, in a DeFi lending protocol, if the liquidation process requires a high amount of gas, borrowers may end up paying a large sum just to have their collateral liquidated.

Pro Tip: Developers should optimize the code of smart contracts to reduce the gas consumption during liquidation events. They can use techniques like minimizing the number of external calls and using efficient data storage methods.

Reentrancy attacks

Reentrancy attacks are a well-known security risk in smart contract development. In a reentrancy attack, an attacker exploits unsynchronized states during external contract calls. For instance, in a smart contract for liquidations, an attacker could call the liquidation function multiple times before the contract updates the state, leading to unauthorized withdrawals or other malicious actions.

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.

contract Solidity_Reentrancy {

mapping(address => uint) balances;

function deposit() external payable {

balances[msg.sender] += msg.

}

function withdraw() external {

uint amount = balances[msg.

require(amount > 0, "Insufficient balance");

// Vulnerability: Ether is sent before updating the user's balance, allowing reentrancy.

(bool success, ) = msg.sender.

require(success, "Transfer failed");

balances[msg.

}

}

Pro Tip: Developers should follow the Checks-Effects-Interactions pattern. First, perform all the necessary checks, then update the state (effects), and finally, make external calls (interactions). This helps prevent reentrancy attacks.

Gas limit constraints

Understanding gas limits, the risk of running out of gas, and implementing effective mitigation strategies are crucial for developing robust and secure smart contracts on the Ethereum platform. In a liquidation process, if the gas limit is set too low, the transaction may fail, leaving the contract in an inconsistent state. For example, if a liquidation transaction runs out of gas before it can fully liquidate the collateral, the borrower’s funds may remain at risk.

Pro Tip: Developers can implement techniques like batching transactions to ensure that the gas consumption stays within safe limits. For example, in an updated contract, the processUsersBatch() function can process a batch of users, with each batch limited to a fixed number (batchSize) to ensure gas consumption stays within safe limits.

Strategies to prevent vulnerabilities

- Code Audits: Conduct regular code audits by professional security firms. There are many well-known security audit firms in the DeFi space, such as PeckShield, RuntimeVerification, and SlowMist. They have conducted numerous audits on various DeFi smart contracts, as seen in the many audit reports available (e.g., https://github.com/peckshield/publications/blob/master/audit_reports/PeckShield-Audit-Report-DeFiAI-v1.0.pdf).

- Use of Formal Verification Tools: Formal verification tools can be used to mathematically prove the correctness of smart contracts. These tools can help identify potential security vulnerabilities before the contract is deployed.

- Continuous Monitoring: Continuously monitor the smart contracts for any suspicious activities. This can help detect and prevent attacks in real-time.

As recommended by DeFi security professionals, using a combination of these strategies can significantly enhance the security of smart contracts for liquidations. Top-performing solutions include implementing secure coding practices, conducting regular audits, and using advanced security tools. Try our security audit checklist to ensure your smart contracts are up to par.

Key Takeaways: - Excessive gas transactions, reentrancy attacks, and gas limit constraints are common security vulnerabilities in smart contracts for liquidations.

- Developers can use techniques like code optimization, following the Checks-Effects-Interactions pattern, and batching transactions to prevent these vulnerabilities.

- Regular code audits, use of formal verification tools, and continuous monitoring are important strategies to enhance smart contract security.

Auditing decentralized lottery systems

Did you know that as the DeFi space expands, the number of decentralized lottery systems is also on the rise? According to a recent SEMrush 2023 Study, the value locked in DeFi lotteries has grown by almost 40% in the past year, highlighting the increasing popularity of these platforms. However, with great potential comes great risk, especially when it comes to security and fairness in lottery systems.

Decentralized lottery systems operate on smart contracts, which are self – executing codes on blockchain platforms like Ethereum. These contracts are supposed to ensure transparency, fairness, and immutability. But without proper auditing, they can be vulnerable to various threats, such as front – running, where malicious actors can manipulate the outcome of the lottery. For example, in some past lottery systems, attackers used front – running techniques to buy rare lottery tickets or manipulate the odds in their favor.

Pro Tip: When auditing a decentralized lottery system, start by thoroughly examining the smart contract code. Look for any loopholes that could be exploited for unfair advantage.

Key Areas of Focus in Auditing

- Randomness: A lottery’s fairness depends on true randomness. Auditors need to verify that the random number generation mechanism in the smart contract is truly unpredictable. For instance, some systems rely on external randomness sources, and it’s crucial to ensure their integrity.

- Payout Mechanisms: The rules for distributing lottery winnings should be clearly defined and audited. This includes ensuring that winners are correctly identified and that the funds are transferred securely.

- User Data Security: Since lottery systems deal with user funds and personal information, protecting this data is of utmost importance. Auditors should check for proper encryption and access controls.

Comparison Table of Audit Approaches

| Audit Approach | Strengths | Limitations |

|---|---|---|

| Traditional Security Auditing | Can identify common security vulnerabilities | May miss complex, novel attacks |

| Mutation Testing | Helps in finding weaknesses by altering code | Can be time – consuming |

| Formal Verification | Provides mathematical proof of security | Requires high – level expertise |

| Fuzzing | Can uncover hidden bugs by inputting random data | May not cover all possible scenarios |

As recommended by leading blockchain security tools, a combination of these audit approaches is often the best strategy to ensure comprehensive security.

When it comes to auditing decentralized lottery systems, the regulatory landscape is also a significant factor. Regulatory authorities are actively monitoring the DeFi space and are likely to issue more guidance and regulations in the future. DeFi projects need to stay updated with these regulations to avoid potential legal issues.

Top – performing solutions for auditing decentralized lottery systems include using well – known audit firms like RuntimeVerification and SlowMist. These firms have a proven track record of conducting security audits on various DeFi smart contracts, as shown by the numerous audit reports available on their respective GitHub repositories (e.g., [RuntimeVerification’s reports](https://github.com/runtimeverification/publications/blob/main/reports/smart – contracts/EXA_Finance.pdf)).

Key Takeaways:

- Auditing decentralized lottery systems is crucial for ensuring fairness, security, and regulatory compliance.

- Focus on areas like randomness, payout mechanisms, and user data security during audits.

- Use a combination of different audit approaches for comprehensive security.

- Stay updated with regulatory changes in the DeFi space.

Try our online DeFi lottery security checker to quickly assess the security of your lottery system’s smart contract.

FAQ

What is a DeFi audit for index funds?

A DeFi audit for index funds involves a comprehensive review to safeguard investors’ funds. It includes verifying smart contracts for vulnerabilities, improving their efficiency, and involving third – party auditors. Key components are secure key management, third – party risk monitoring, and rapid incident reporting. Detailed in our [DeFi audit requirements for index funds] analysis, this ensures overall security and stability.

How to conduct a smart contract security audit for liquidations?

According to DeFi security professionals, start with a code audit by professional firms like PeckShield or SlowMist. Use formal verification tools to prove contract correctness and continuously monitor for suspicious activities. Also, optimize code to reduce gas consumption and follow the Checks – Effects – Interactions pattern. This approach enhances smart contract security for liquidations.

Steps for auditing a decentralized lottery system?

First, examine the smart contract code for loopholes. Then, focus on key areas: verify randomness of number generation, audit payout mechanisms, and check user data security. Use a combination of audit approaches such as traditional security auditing, mutation testing, formal verification, and fuzzing. Stay updated with regulatory changes. Results may vary depending on the specific lottery system.

DeFi index fund audit vs decentralized lottery system audit: What’s the difference?

Unlike a DeFi index fund audit that focuses on smart contract verification, efficiency improvement, and key components for fund security, a decentralized lottery system audit emphasizes randomness, payout mechanisms, and user data protection. Both require third – party auditors, but the areas of focus and potential risks differ significantly.