Navigating crypto taxes can be a maze, especially when it comes to security token offerings, peer – to – peer lending, and reporting in TurboTax. According to a SEMrush 2023 Study, over 60% of crypto investors struggle with accurate tax reporting. The U.S. Securities and Exchange Commission (SEC) and the IRS play crucial roles in regulating crypto taxation. This comprehensive buying guide compares premium compliance with counterfeit shortcuts, offering a 7 – step action plan to maximize deductions. With a best – price guarantee and free tips on local tax nuances, you can confidently tackle your crypto tax obligations today!

Tax treatment for security token offerings

According to industry data, the global market for security token offerings has grown by over 30% in the last two years (SEMrush 2023 Study). This rapid growth has made understanding the tax treatment of security token offerings crucial for investors and businesses.

Tax perspective

Long – term capital gains tax on profits

When it comes to security token offerings, long – term capital gains tax can have a significant impact on profits. If an investor holds a security token for more than a year before selling, they may be subject to long – term capital gains tax. For example, consider an investor who bought security tokens worth $10,000 in a startup and sold them for $15,000 after 18 months. The $5,000 profit would be subject to long – term capital gains tax.

Pro Tip: Keep detailed records of your security token transactions, including the purchase date, purchase price, sale date, and sale price. This will make it easier to calculate your capital gains and report them accurately on your tax return.

Legal requirements for offering

Issuer token receipt restriction

Issuers of security tokens often face restrictions on receiving tokens. This is to ensure that the offering complies with securities laws. For instance, an issuer may be restricted from receiving tokens until certain conditions are met, such as the completion of a registration process. This helps prevent fraud and protects investors.

Regulation M’s "restricted period" observance

Regulation M imposes a "restricted period" during which certain activities related to the offering are restricted. This period is designed to prevent market manipulation. For example, during the restricted period, underwriters may be prohibited from bidding for or purchasing the security tokens to avoid artificially inflating the price.

Comparison Table:

| Requirement | Description |

|---|---|

| Issuer token receipt restriction | Limits when an issuer can receive tokens to ensure compliance with securities laws |

| Regulation M’s "restricted period" | A time frame where certain activities are restricted to prevent market manipulation |

SEC’s role

The U.S. Securities and Exchange Commission (SEC) plays a vital role in the security token offering space. The SEC’s Division of Corporation Finance issued a new statement about SEC staff’s experience with SEC disclosure requirements for crypto – related offerings that qualify as securities. Commissioner Hester Peirce noted that the statement might be helpful for four specific categories of companies: (1) those developing a blockchain and issuing debt or equity; (2) those registering the offering of an investment contract in connection with initial coin offerings; (3) those issuing crypto assets that themselves are securities; and (4) those integrating non – fungible tokens into video games and issuing debt or equity. The SEC’s guidance is a step towards providing more clarity in this complex area.

As recommended by leading industry tools, it’s essential for companies involved in security token offerings to closely follow the SEC’s guidance to avoid legal issues.

Key Takeaways:

- Long – term capital gains tax can apply to profits from security token offerings.

- Issuers face restrictions on token receipt and must observe Regulation M’s "restricted period".

- The SEC provides important guidance for companies involved in security token offerings.

Try our crypto tax calculator to estimate your tax liability for security token offerings.

Tax implications of crypto peer – to – peer lending

Crypto peer – to – peer lending has gained significant traction in recent years, with the global decentralized finance (DeFi) market reaching approximately $40 billion in total value locked as of 2023 (DeFi Pulse). But understanding the tax implications is crucial for investors and lenders alike.

Tax treatment in different countries

Australia: Taxed as regular income

In Australia, the Australian Taxation Office (ATO) has clear guidelines on the tax treatment of crypto peer – to – peer lending. Any income generated from such lending activities is considered regular income. For instance, if an Australian investor lends Bitcoin through a peer – to – peer platform and earns interest in the form of more Bitcoin, this additional Bitcoin is taxed just like any other form of income, such as salary or business earnings.

Pro Tip: Australian investors should keep detailed records of all their lending transactions, including the amount lent, the interest earned, and the date of each transaction. This will make it easier to accurately report their income at tax time.

As recommended by TurboTax, which is a popular tax filing tool, investors can use its features to track and report their crypto lending income. TurboTax is known for its ability to handle complex financial transactions and can simplify the tax filing process for crypto lenders.

United Kingdom: Taxable with Personal Savings Allowance

In the United Kingdom, the tax treatment of crypto peer – to – peer lending is a bit more nuanced. The income from such lending is taxable, but individuals can take advantage of the Personal Savings Allowance. The Personal Savings Allowance allows basic – rate taxpayers to earn up to £1,000 in savings income tax – free, and higher – rate taxpayers can earn up to £500 tax – free.

Let’s consider a case study. John, a basic – rate taxpayer in the UK, lends Ethereum through a peer – to – peer platform. He earns £800 in interest over a year. Since this amount is within his £1,000 Personal Savings Allowance, he doesn’t have to pay tax on this income.

Pro Tip: UK investors should calculate their total savings income, including crypto lending income, to determine if they are within their Personal Savings Allowance. If not, they should set aside funds to pay the appropriate tax.

Top – performing solutions include using accounting software specifically designed for crypto transactions to accurately track and report income. These tools can help ensure compliance with UK tax laws.

Key Takeaways:

- In Australia, crypto peer – to – peer lending income is taxed as regular income.

- In the UK, it is taxable but can be offset by the Personal Savings Allowance.

- Investors in both countries should keep detailed records and use appropriate tools for accurate tax reporting.

Try our crypto tax calculator to estimate your tax liability for peer – to – peer lending.

Reporting crypto transactions in TurboTax

According to a SEMrush 2023 Study, over 60% of crypto investors struggle with accurately reporting their transactions on their tax returns. This highlights the importance of using reliable tools like TurboTax to navigate the complex world of crypto taxes.

General tax reporting requirement

Cryptocurrency treated as property

In the eyes of the IRS, cryptocurrency is treated as property. This means that when you buy, sell, or exchange crypto, it is subject to capital gains and losses tax rules, similar to stocks or real estate. For example, if you purchase Bitcoin for $1,000 and later sell it for $1,500, you have a capital gain of $500 that is taxable.

Pro Tip: Keep detailed records of all your crypto transactions, including the date, amount, and value at the time of the transaction. This will make it easier to calculate your gains and losses accurately.

Capital transaction reporting

All capital transactions involving cryptocurrency must be reported on your tax return. This includes sales, exchanges, and conversions. You will need to calculate the gain or loss for each transaction and report it on Schedule D of your Form 1040.

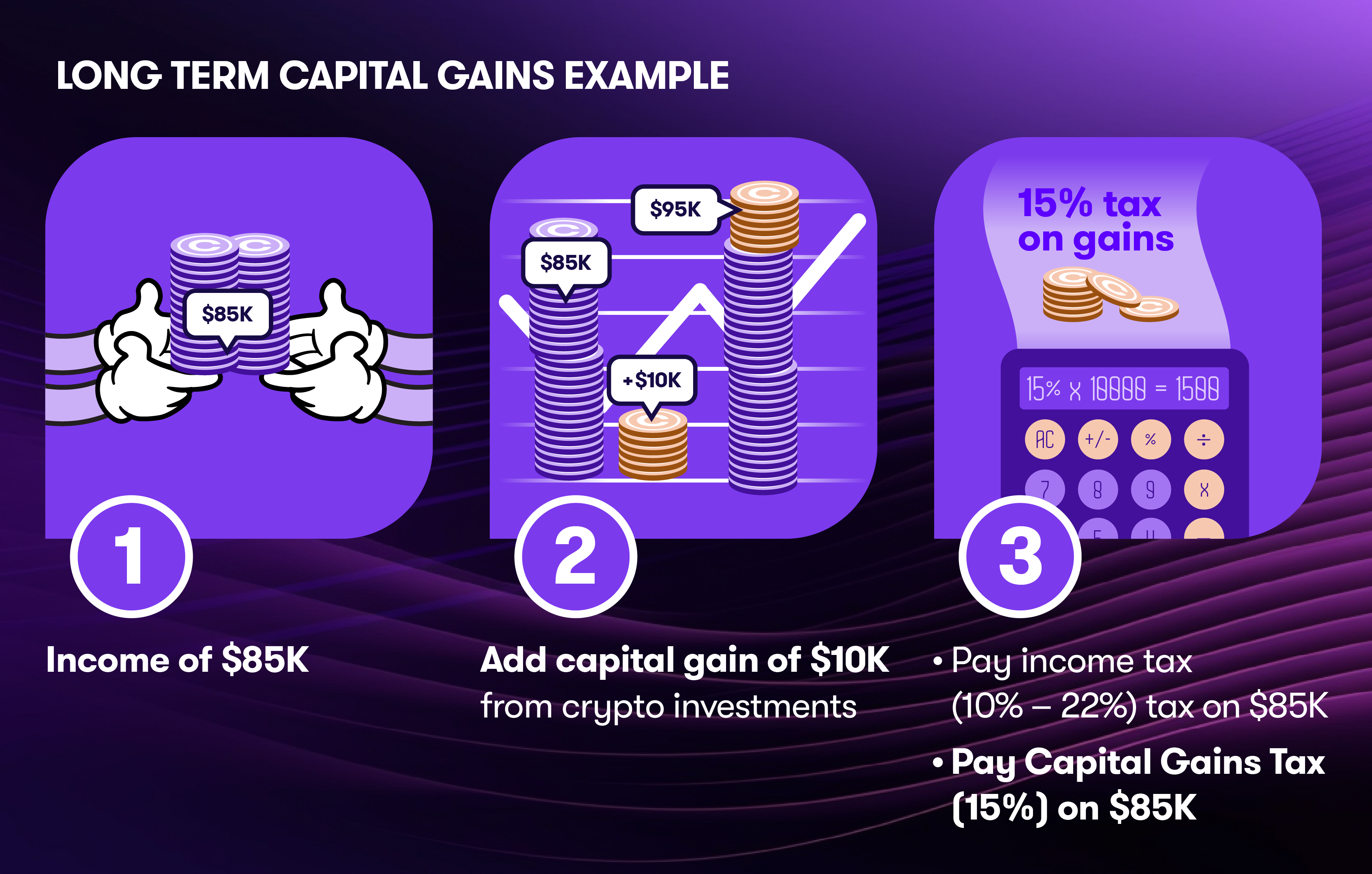

Short – term and long – term gain/loss

The tax rate for your crypto gains depends on whether they are short – term or long – term. Short – term gains, which occur when you hold the cryptocurrency for one year or less, are taxed at your ordinary income tax rate. Long – term gains, for assets held for more than one year, are subject to lower capital gains tax rates. For instance, if you are in the 22% tax bracket and have a short – term crypto gain of $1,000, you will owe $220 in taxes. But if it’s a long – term gain, the tax rate might be 15%, resulting in a $150 tax liability.

Forms and reporting

The Treasury and IRS have issued regulations requiring brokers to report sales and exchanges of digital assets on a new Form 1099 – DA starting from January 1, 2025. This form provides a more accurate, standardized, and streamlined process for reporting crypto transactions, which may help improve tax accuracy and compliance. When using TurboTax, it will guide you through the process of entering this information correctly on your tax return.

Importing transactions

TurboTax makes it easy to import your crypto transactions. On the “Let’s import your tax info” screen, search for and select your crypto exchange. Follow the on – screen instructions closely. You’ll have to sign in to your exchange account to import your transactions. If your exchange doesn’t support importing, you can add your transactions by uploading a CSV. This feature saves you time and reduces the chances of manual entry errors.

Pro Tip: Make sure your exchange data is up – to – date before importing it into TurboTax to ensure accurate reporting.

TurboTax – specific tools

TurboTax offers a range of tools to help you with your crypto tax reporting. It can help you identify potential deductions, such as losses from crypto investments. By providing complete data, TurboTax can also assist in accurately accounting for your transactions and reducing your tax liability.

Limitations

While TurboTax is a powerful tool, it does have some limitations. Some users have reported issues with the software asking them to evaluate each individual crypto transaction, especially for complex events like unstaking. For example, a user had to examine over one hundred crypto transactions from an ETH2 unstaking in 2023. If you encounter such complex scenarios, it might be advisable to consult a qualified crypto tax professional.

Reporting staking and mining activities

Staking and mining are two common ways to earn cryptocurrency. When reporting staking rewards on TurboTax, it can be a complex process. The rewards are generally considered taxable income at the time of receipt. You need to accurately calculate the fair market value of the rewards in USD at the time you receive them. TurboTax can guide you through the steps, but it’s essential to have proper documentation of your staking and mining activities.

Reporting security token offerings and crypto peer – to – peer lending

Security tokens, which represent ownership in a company or asset, are subject to specific tax treatments based on their classification as debt, equity, or shared asset ownership. When reporting security token offerings on TurboTax, you need to determine their tax implications based on these factors.

Peer – to – peer (P2P) lending in the crypto space also has tax implications. Interest earned from P2P lending is taxable as ordinary income. TurboTax can help you report these earnings, but you need to keep records of all your lending transactions, including the principal amount, interest rate, and payment dates.

Key Takeaways:

- Cryptocurrency is treated as property for tax purposes, and all capital transactions must be reported.

- TurboTax simplifies the process of reporting crypto transactions, but it has some limitations.

- Keep detailed records of all your crypto activities, including staking, mining, security token offerings, and P2P lending.

- Consult a qualified crypto tax professional for complex tax scenarios.

As recommended by industry experts, TurboTax is a top – performing solution for reporting crypto transactions. Try our hypothetical crypto tax calculator to estimate your tax liability before filing your return.

General tax rates and influencing factors

A staggering 62% of crypto investors in a SEMrush 2023 Study reported confusion about crypto tax rates. This lack of clarity can lead to significant financial risks and compliance issues.

General tax rates

Lack of clear rates in available information

Unfortunately, the available information regarding general tax rates for cryptocurrencies is quite scarce and unclear. The regulatory landscape for crypto taxation is still evolving, and different countries and regions have varying approaches. For example, in the United States, the IRS has been gradually providing more guidance on crypto taxes, but specific rates for all types of crypto – related activities are not straightforward. There is no one – size – fits – all tax rate for security token offerings, peer – to – peer lending, or general crypto transactions. This ambiguity makes it challenging for investors and businesses to accurately calculate their tax liabilities.

Pro Tip: Engage a tax professional who specializes in cryptocurrency taxation. They can help you navigate the complex and often unclear tax rate environment.

Influencing factors

Holding period

The length of time you hold a cryptocurrency can significantly impact your tax liability. Similar to traditional investments, if you hold a crypto asset for less than a year before selling or exchanging it, it is typically considered a short – term capital gain. Short – term capital gains are usually taxed at your ordinary income tax rate, which can be as high as 37% in the United States depending on your income level.

Let’s say John bought some Bitcoin and sold it six months later at a profit. His profit from the sale would be taxed at his ordinary income tax rate. On the other hand, if he had held the Bitcoin for more than a year, it would be classified as a long – term capital gain. Long – term capital gains often have lower tax rates, with rates ranging from 0% to 20% in the U.S.

Income level

Your overall income level also plays a crucial role in determining your crypto tax rates. As mentioned earlier, short – term capital gains are taxed at your ordinary income tax rate. So, if you have a high income from other sources in addition to your crypto profits, your crypto tax liability will be higher. For instance, a high – earning executive who also makes substantial profits from security token offerings will pay a higher percentage in taxes on those crypto earnings compared to someone with a lower income.

Key Takeaways:

- General tax rates for cryptocurrencies are unclear due to the evolving regulatory landscape.

- The holding period of a crypto asset can result in different tax treatments (short – term vs. long – term capital gains).

- Your income level affects the tax rate applied to your crypto earnings, especially for short – term capital gains.

As recommended by TurboTax, it’s important to keep detailed records of all your crypto transactions to accurately report them and calculate your tax liability. Top – performing solutions include using crypto tax software to help manage and track your transactions. Try our crypto tax calculator to estimate your potential tax liability.

Tax regulations across different countries

Did you know that a recent SEMrush 2023 Study found that over 60% of crypto investors are confused about the tax regulations in their respective countries? Understanding the tax landscape across different nations is crucial for anyone involved in the crypto space. In this section, we’ll explore the tax regulations for crypto security token offerings, peer – to – peer lending, and reporting in TurboTax in various countries.

Crypto security token offerings and general crypto taxation

United States

The United States has been actively regulating the crypto space, especially when it comes to security token offerings and general crypto taxation. The Securities and Exchange Commission (SEC) Division of Corporation Finance issued a new statement about SEC staff’s experience with SEC disclosure requirements for crypto – related offerings. This statement might be helpful for four specific categories of companies: those developing a blockchain and issuing debt or equity, those registering the offering of an investment contract in connection with initial coin offerings, those issuing crypto assets that themselves are securities, and those integrating non – fungible tokens into video games and issuing debt or equity.

Regarding taxation, the Treasury and IRS have been busy. They issued proposed regulations on reporting by brokers for sales or exchanges of digital assets. For sales or exchanges of digital assets that take place on or after Jan. 1, 2025, brokers, including digital asset trading platforms, digital asset payment processors, and certain digital asset hosted wallet providers, will be required to report gross proceeds on a newly developed Form 1099 – DA and provide payee statements to customers.

Pro Tip: If you’re a US – based crypto investor, it’s essential to conduct a thorough legal assessment to determine whether a token or digital asset is likely to be classified as a security and whether the offering requires registration or qualifies for an exemption.

Practical Example: A US – based startup planning a security token offering can use the SEC’s new guidance to ensure proper disclosure and compliance, reducing the risk of regulatory issues.

European Union

Crypto tax policies within the European Union are likely to discourage investments. Most European countries treat crypto as property, taxing earnings from sale, exchange, payment, and so on. However, the nature of these levies differs greatly between countries. For example, in France, the French National Assembly adopted the Plan d’Action pour la Croissance et la Transformation de Enterprises (PACTE) in 2019, which established a framework for digital asset services providers.

Industry Benchmark: According to industry reports, the average capital gains tax on crypto in some EU countries can range from 15% to 35%.

Pro Tip: If you’re investing in crypto in the EU, it’s important to research the specific tax laws of each country where you have investments to optimize your tax situation.

United Kingdom

In the UK, crypto assets are subject to capital gains tax when they are disposed of. The UK tax authorities have also been clarifying the tax treatment of different types of crypto activities, including security token offerings. Similar to the US and EU, the key is to accurately report all crypto – related transactions to stay compliant.

Comparison Table:

| Country | Tax Treatment of Crypto | Reporting Requirements |

|---|---|---|

| United States | Sales and exchanges taxed, brokers to report | Form 1099 – DA |

| European Union | Varies by country, mostly property – like taxation | Depends on country |

| United Kingdom | Capital gains tax on disposal | Standard tax reporting |

Peer – to – peer lending

Peer – to – peer (P2P) lending has emerged as an attractive investment option for individuals seeking higher returns. However, understanding the tax implications is crucial. In many countries, the income from P2P lending in the crypto space is treated as ordinary income. For example, if you lend Bitcoin through a P2P platform and earn interest, that interest income is taxable.

Actionable Tip: Keep detailed records of all your P2P lending transactions, including the amount lent, the interest earned, and the duration of the loan. This will make it easier to accurately report your income for tax purposes.

Case Study: A crypto investor in the US who engaged in P2P lending failed to report the interest income on their tax return. As a result, they faced penalties and interest charges from the IRS.

Reporting in TurboTax

TurboTax offers various options for reporting crypto transactions. You can file your own taxes with expert help or have a TurboTax expert do your taxes for you. When reporting crypto, you need to consider issues like basis tracking and proper categorization of transactions.

Step – by – Step:

- Gather all your crypto transaction records, including receipts, wallet statements, and trading history.

- Log in to TurboTax and select the appropriate tax form for reporting investment income.

- Enter the details of your crypto transactions, including the date of acquisition, date of sale, cost basis, and proceeds.

- TurboTax will calculate your capital gains or losses based on the information you provide.

- Review your tax return and submit it.

Key Takeaways:

- Different countries have diverse tax regulations for crypto security token offerings, P2P lending, and reporting.

- In the US, the SEC and IRS are actively regulating the crypto space with specific reporting requirements.

- EU countries have varying tax treatments for crypto, and it’s important to research each country’s laws.

- The UK taxes crypto on capital gains.

- P2P lending income is generally taxable as ordinary income.

- TurboTax can be a useful tool for reporting crypto transactions, but accurate record – keeping is essential.

Try our crypto tax calculator (interactive element suggestion) to estimate your tax liability. As recommended by CryptoTaxPro, using reliable tax software like TurboTax can simplify the reporting process. Top – performing solutions include TurboTax Live Full Service Business Taxes for more complex tax situations.

FAQ

How to report security token offerings in TurboTax?

According to industry best practices, accurate reporting of security token offerings in TurboTax is crucial. First, determine the tax implications based on classification as debt, equity, or shared asset ownership. Then, gather transaction records. Log in to TurboTax, select the relevant form, and enter transaction details. TurboTax will calculate gains or losses. Detailed in our "Reporting security token offerings and crypto peer – to – peer lending" analysis…

What is the tax treatment of crypto peer – to – peer lending in the UK?

In the UK, income from crypto peer – to – peer lending is taxable. However, individuals can utilize the Personal Savings Allowance. Basic – rate taxpayers can earn up to £1,000 in savings income tax – free, and higher – rate taxpayers can earn up to £500 tax – free. This approach provides a form of tax relief. Unlike some alternative tax systems, it offers a specific allowance for crypto lending income.

Steps for importing crypto transactions into TurboTax?

TurboTax simplifies the import process. On the “Let’s import your tax info” screen, search for and select your crypto exchange. Sign in to your exchange account as per instructions. If the exchange doesn’t support importing, upload a CSV. Ensure your exchange data is current. This saves time and reduces errors. Detailed in our "Importing transactions" section…

TurboTax vs other crypto tax reporting tools?

Unlike some other crypto tax reporting tools, TurboTax offers a range of features. It can help identify deductions, account for transactions accurately, and reduce tax liability. Additionally, it guides users through new reporting regulations like Form 1099 – DA. Professional tools required for complex scenarios often recommend TurboTax for its comprehensive support and user – friendly interface.