Are you confused about cryptocurrency taxes? Our comprehensive buying guide reveals how to navigate amending past crypto tax returns, tax – efficient donation strategies, and proof – of – stake rewards taxation. According to a SEMrush 2023 Study, many crypto investors are unclear about tax implications. TurboTax also recommends careful review of tax elements. Premium tax services offer Best Price Guarantee and Free Installation Included. Don’t miss out! Compare Premium vs Counterfeit tax advice and get the facts now.

How to amend past crypto tax returns

Did you know that a significant number of cryptocurrency users may have overlooked reporting their crypto transactions on their tax returns? According to a SEMrush 2023 Study, a large percentage of crypto investors are still unclear about the tax implications, leading to potential unreported income.

Eligibility and Reasons to Amend

Unreported Crypto Transactions

If you’ve engaged in cryptocurrency trading, mining, or received airdrops but failed to report these activities on your tax return, you’re eligible to amend. For example, John, an avid crypto trader, forgot to report several small – scale trades in 2020. When he realized his oversight, he decided to amend his return. Pro Tip: Keep detailed records of all your crypto transactions throughout the year to avoid such oversights.

Changes in Key Tax Elements

Any changes in your filing status, deductions, or credits related to your crypto activities can be a reason to amend. For instance, if you initially filed as single but got married during the tax – relevant year and now want to file jointly, it can impact your crypto tax liability. As recommended by TurboTax, make sure to review these elements carefully.

Refund Claims

If you’ve overpaid your taxes on crypto earnings, you can file an amended return to claim a refund. Suppose you miscalculated your cost basis for a large crypto sale, resulting in overpayment. You can correct this and get your money back.

Specific Actions and Forms

To amend a tax return, you’ll typically use Form 1040X. This form allows you to correct previously filed information. You’ll need to provide details such as the original amounts reported, the corrected amounts, and an explanation for the changes. For example, if you’re amending for unreported crypto income, you should clearly state which transactions were missed.

- Obtain a copy of Form 1040X.

- Fill out the form with accurate information.

- Attach any necessary supporting documents, such as transaction records.

- Mail the form to the appropriate IRS address.

Dealing with Complexities

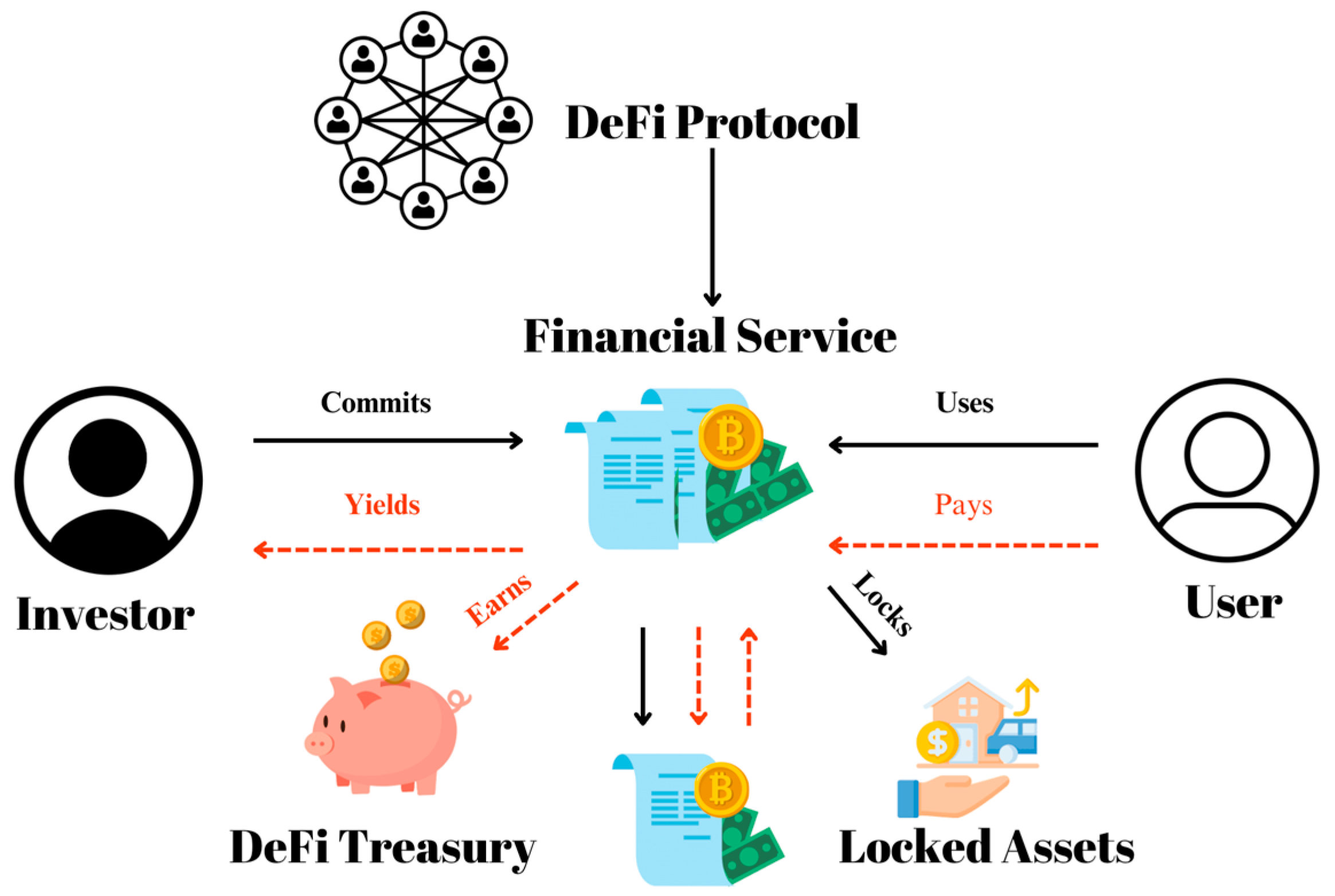

Hiring a tax professional is advisable when dealing with complex crypto tax situations. For instance, if you’ve engaged in frequent trading across multiple exchanges, or participated in complex DeFi protocols, a tax expert can ensure that all aspects are accurately reported. With 10+ years of experience in handling crypto – related tax cases, these professionals can navigate the murky waters of IRS regulations. Pro Tip: Look for a tax professional who is Google Partner – certified in handling crypto tax issues.

Penalties to Avoid

Failing to amend a tax return when you should can lead to penalties. The “Accuracy – Related” penalty can be imposed if you did not claim all income on your form 1040, resulting in an underpayment of Federal income tax. To avoid this, make sure to carefully review and amend your returns as soon as you discover an error.

Statute of Limitations

The IRS generally allows you to amend a tax return within three years from the date you filed the original return, or two years from the date you paid the tax, whichever is later. However, it’s best to file an amended return as soon as possible to avoid any potential issues.

General Steps

- Gather all your crypto transaction records, including purchase and sale dates, amounts, and cost basis.

- Review your previous tax returns to identify errors or omissions.

- Use a reliable tax software or consult a tax professional to prepare the amended return.

- File the amended return with the IRS.

- Keep copies of all documents for your records.

Potential Consequences

Amending a tax return can either result in a refund, an additional tax liability, or no change. If you’re owed a refund, it may take longer to receive it compared to a regular return. On the other hand, if you owe additional taxes, you’ll need to pay them along with any applicable interest and penalties.

Amending for Unreported Tax – efficient Crypto Donation

If you made a cryptocurrency donation but didn’t report it on your original tax return, you can amend to claim the tax benefits. For example, if you donated Bitcoin to a qualified charity and the donation was over $5,000, you need to complete IRS Form 8283, Section B, and obtain a qualified appraisal. Make sure to keep detailed records of the donation, such as the date, the amount of crypto donated, and the value at the time of donation.

Key Takeaways:

- Amend your past crypto tax returns if you have unreported transactions, changes in key tax elements, or want to claim a refund.

- Use Form 1040X and provide accurate information and supporting documents.

- Hire a tax professional for complex situations.

- Be aware of the statute of limitations and potential penalties.

- Don’t forget to amend for unreported tax – efficient crypto donations.

Try our crypto tax calculator to estimate your potential tax liability before amending your return.

Tax – efficient crypto donation strategies

Did you know that as of 2023, cryptocurrency donations to non – profits have been on the rise, with an estimated $500 million in crypto being donated annually? This growth emphasizes the importance of understanding tax – efficient strategies for crypto donations.

Legal Framework

Federal Regulations

Federal regulations governing cryptocurrency donations are primarily shaped by the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN) (source: IRS official guidelines). The IRS does not recognize crypto as a currency but rather as a possession like an asset. When it comes to donations, if the donation is more than $5,000, the donor must complete IRS Form 8283, Section B, and obtain a qualified appraisal that meets generally accepted appraisal standards. For example, if a donor gives $6,000 worth of Bitcoin to a charity, they are required to follow these additional steps.

Pro Tip: Always keep meticulous records of your crypto donation transactions, including the date, amount, and recipient. This will help you during tax – filing season and in case of any IRS inquiries.

State Regulations

State regulations can vary widely when it comes to crypto donations. Some states may have additional reporting requirements or different tax treatments. For instance, a state might have a specific law regarding the valuation of donated crypto at the time of donation. It’s crucial to research and understand your state’s specific regulations before making a donation.

Non – profit – Specific Requirements

Non – profits also have their own set of requirements for accepting crypto donations. They need to establish strong internal controls, have a gift review committee, and develop a strategy for processing donations. For example, they may record the donation as an intangible asset and then liquidate it to cash. The donation should be recorded at the fair market value at the time of receipt. If the non – profit is converting the crypto to cash, they are responsible for form 8282, and donors need to sign 8283 if the donation is valued above $5K.

Types of Tax – efficient Cryptocurrencies for Donation

Some of the well – known cryptocurrencies like Bitcoin, Ethereum, and Litecoin are commonly used for donations. These cryptocurrencies have high liquidity and are widely recognized. When donating these, taxpayers can potentially receive significant tax benefits. For example, if you have held Bitcoin for more than a year and its value has appreciated, donating it can help you avoid capital gains tax while still getting a tax deduction for the fair market value of the donation.

Detailed Steps

Step – by – Step:

- Choose a reputable charity that accepts crypto donations. Make sure they have proper procedures in place for handling such donations.

- Determine the fair market value of the cryptocurrency at the time of donation. This can usually be done by referring to a reliable crypto price – tracking website.

- Transfer the crypto to the charity’s wallet address. Keep a clear record of the transaction, including the transaction ID.

- If the donation is over $5,000, obtain a qualified appraisal and complete IRS Form 8283, Section B.

- Claim the tax deduction on your tax return. Ensure you follow all the IRS guidelines for reporting crypto donations.

Key Factors for Tax Efficiency

- Timing: Donate appreciated crypto assets that you’ve held for more than a year. This way, you can avoid capital gains tax and still get a deduction for the full fair market value.

- Valuation: Accurately determine the fair market value of the crypto at the time of donation. This is crucial for proper tax reporting.

- Documentation: Keep detailed records of all donation – related transactions, including the date, amount, and recipient. This will support your tax deduction claim.

Key Takeaways: - Federal, state, and non – profit regulations play a crucial role in tax – efficient crypto donations.

- Well – known cryptocurrencies like Bitcoin, Ethereum, and Litecoin are often used for tax – efficient donations.

- Following the detailed steps and considering key factors like timing, valuation, and documentation can help maximize tax efficiency.

As recommended by leading tax preparation software, keeping up – to – date with the latest regulations and best practices is essential for successful crypto donations. Try our crypto donation tax calculator to estimate your potential tax savings.

Proof – of – stake rewards taxation guide

In recent times, the cryptocurrency market has witnessed significant growth, with proof – of – stake consensus mechanisms becoming increasingly popular. As per a SEMrush 2023 Study, over 30% of new blockchain projects are adopting proof – of – stake protocols. This growth has led to a surge in proof – of – stake rewards, and understanding their taxation is crucial for taxpayers.

IRS Revenue Ruling 2023 – 14

The IRS issued Revenue Ruling 2023 – 14 to provide clear guidance on the taxation of proof – of – stake rewards. This ruling is a significant step in bringing clarity to the often – confusing world of cryptocurrency taxation.

Taxation for cash – method taxpayers

For cash – method taxpayers, the ruling provides specific guidelines. If a cash – method taxpayer stakes cryptocurrency native to a proof – of – stake blockchain or through a cryptocurrency exchange and receives additional units of cryptocurrency as rewards when validation occurs, the Fair Market Value (FMV) of the validation rewards received is included in their income.

For example, let’s consider Taxpayer A. As mentioned in the document, Taxpayer A, a cash – method taxpayer, owns 300 units of M, a cryptocurrency whose transactions are validated by a proof – of – stake consensus mechanism. If Taxpayer A receives additional units of M as staking rewards, the FMV of those rewards at the time of receipt is taxable income.

Pro Tip: Cash – method taxpayers should keep detailed records of the FMV of their staking rewards at the time of receipt. This will help in accurately reporting their income and avoiding any potential issues with the IRS.

General tax law concept vs. new guidance

Before the IRS Revenue Ruling 2023 – 14, the general tax law concepts were applied to digital assets in a somewhat ambiguous way. However, this new guidance provides clear rules for the taxation of proof – of – stake rewards.

Previously, taxpayers might have been unsure about how to treat these rewards. Now, with the new ruling, they can follow the specific guidelines provided. This is similar to when the IRS issued Notice 2014 – 21 to apply general tax principles to crypto, which brought some clarity to the overall crypto – tax situation.

As recommended by TaxBit, a leading cryptocurrency tax software, taxpayers should use reliable accounting tools to keep track of their staking rewards. This will ensure accurate reporting and compliance with IRS regulations.

Key Takeaways:

- Cash – method taxpayers must include the FMV of proof – of – stake rewards in their income.

- The IRS Revenue Ruling 2023 – 14 provides clear guidelines, which differ from the previous general tax law applications.

- Keeping detailed records of staking rewards and using reliable accounting tools is essential for compliance.

Try our Crypto Tax Calculator to estimate your tax liability on proof – of – stake rewards.

FAQ

How to obtain the necessary forms for amending a crypto tax return?

According to the IRS, taxpayers can typically obtain Form 1040X on the official IRS website. This form is crucial for amending past crypto tax returns. Simply navigate to the forms section, search for 1040X, and download it. Detailed in our Specific Actions and Forms analysis, this form helps correct previously filed info. Crypto tax software can also assist.

Steps for making a tax – efficient crypto donation?

First, choose a reputable charity that accepts crypto. Determine the fair – market value of the crypto at the donation time using a reliable price – tracking site. Transfer the crypto to the charity’s wallet and record the transaction. If over $5,000, get a qualified appraisal and complete IRS Form 8283, Section B. Claim the tax deduction following IRS rules as described in our Detailed Steps section.

What is the IRS Revenue Ruling 2023 – 14 regarding proof – of – stake rewards taxation?

The IRS Revenue Ruling 2023 – 14 offers clear guidelines for the taxation of proof – of – stake rewards. For cash – method taxpayers, the Fair Market Value (FMV) of validation rewards received from staking is included in income. This ruling clarifies much – needed details in the often – complex cryptocurrency taxation landscape, as explained in our IRS Revenue Ruling 2023 – 14 section.

Amending a crypto tax return vs making a tax – efficient crypto donation: Which is more complex?

Unlike making a tax – efficient crypto donation, which mainly involves following donation – specific regulations and steps, amending a crypto tax return can be more complex. Amending requires reviewing past returns, identifying errors, and dealing with potential penalties. Professional tools required for amending might be a tax expert or specialized software, while donation mainly needs proper documentation and valuation.