Posted inBlockchain Tax Compliance

Navigating Crypto Tax Compliance, Cost Basis Tracking, and Lending Implications for Expatriates

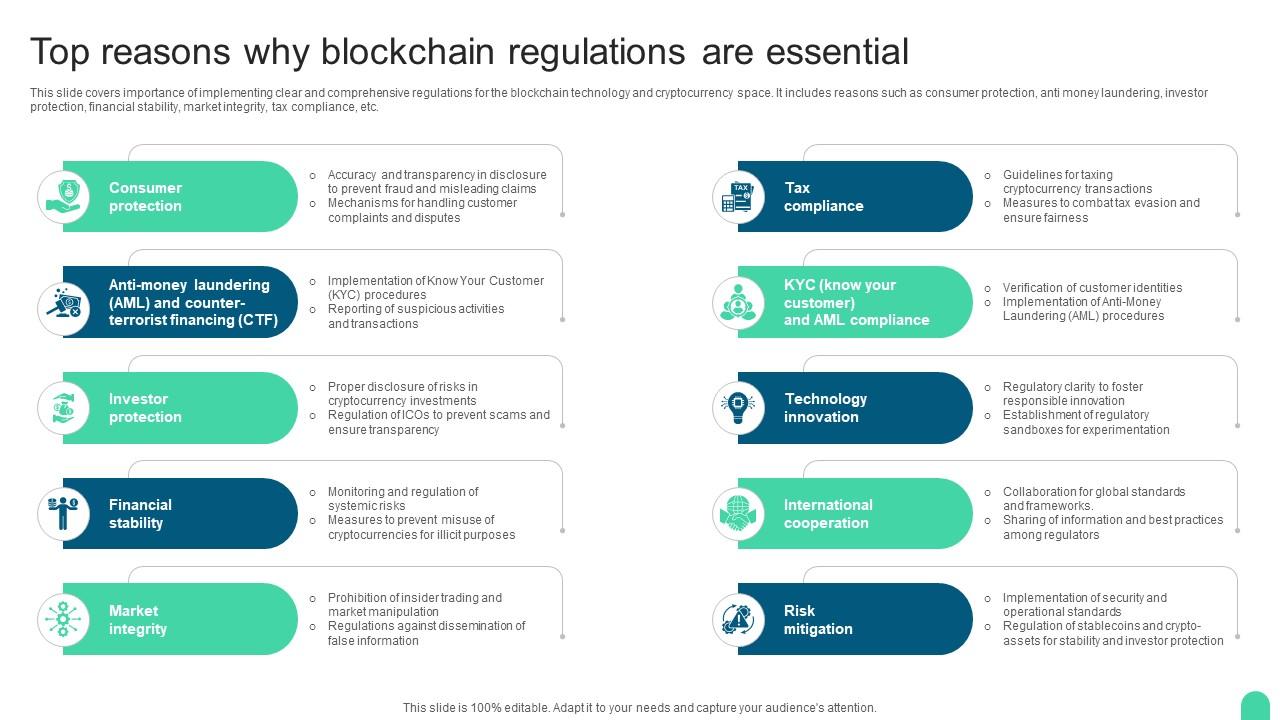

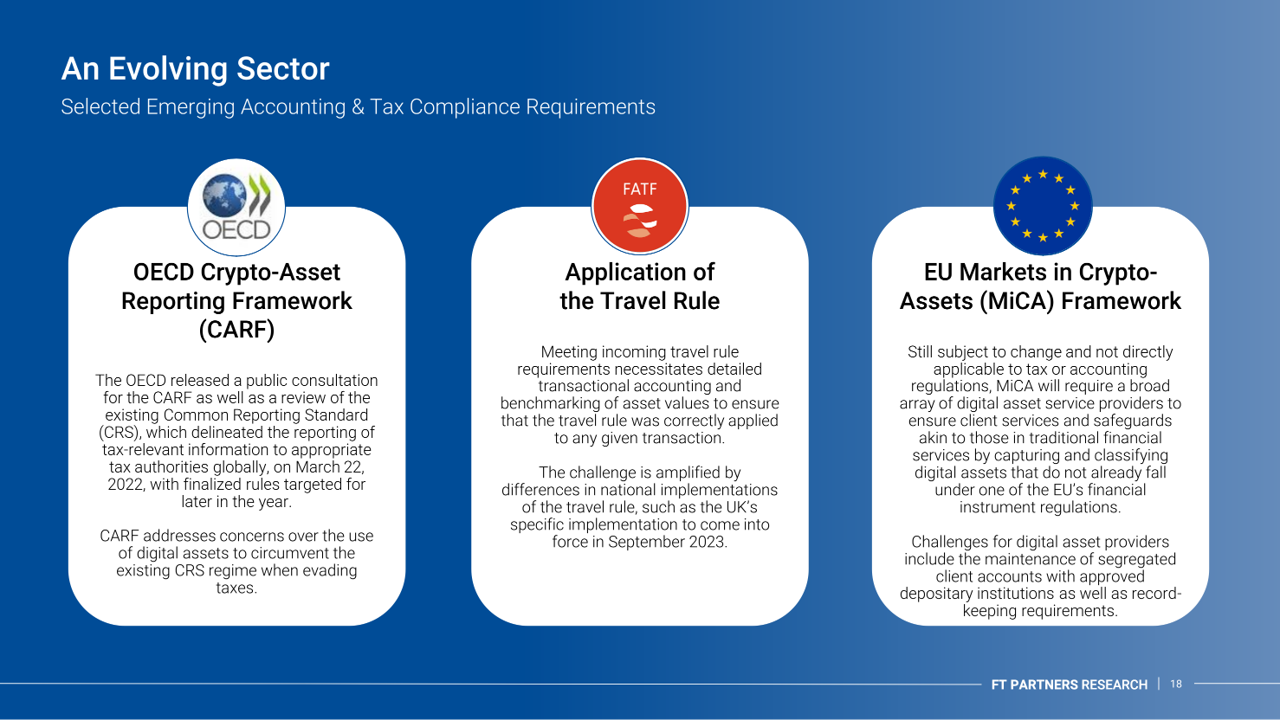

Are you an expatriate navigating the complex world of cryptocurrency? With the upcoming 2025 MiCA legislation and EU travel rule (source 1), staying compliant with crypto tax laws is more…