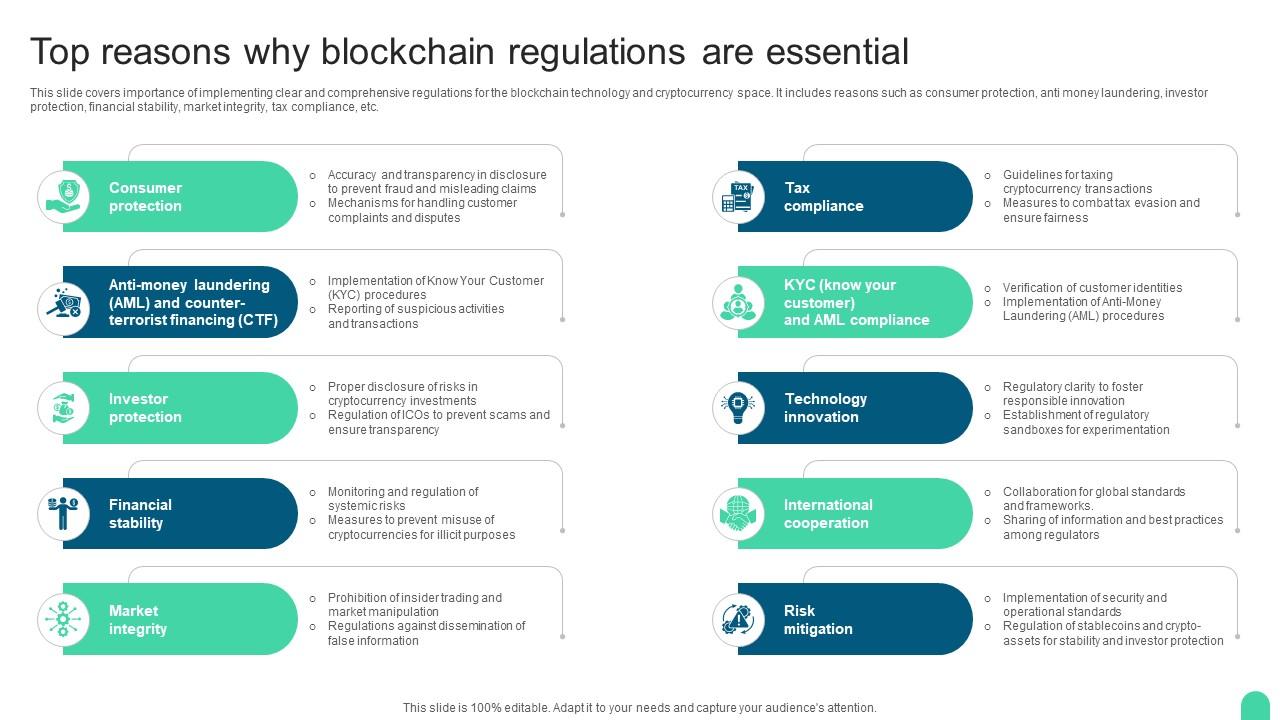

Posted inBlockchain Tax Compliance

Comprehensive Guide: Crypto Tax Implications in Blockchain Gaming, Donations, and Multi – Wallet Transactions

Navigating crypto tax implications is crucial in the booming digital asset landscape. As per SEMrush 2023 Study, the global blockchain gaming market will hit $65 billion by 2028, while the…