Posted inBlockchain Tax Compliance

Navigating Crypto Taxes: Cross – Border Transfers, Hardware Wallet Strategies, and Reporting Stolen/Lost Coins

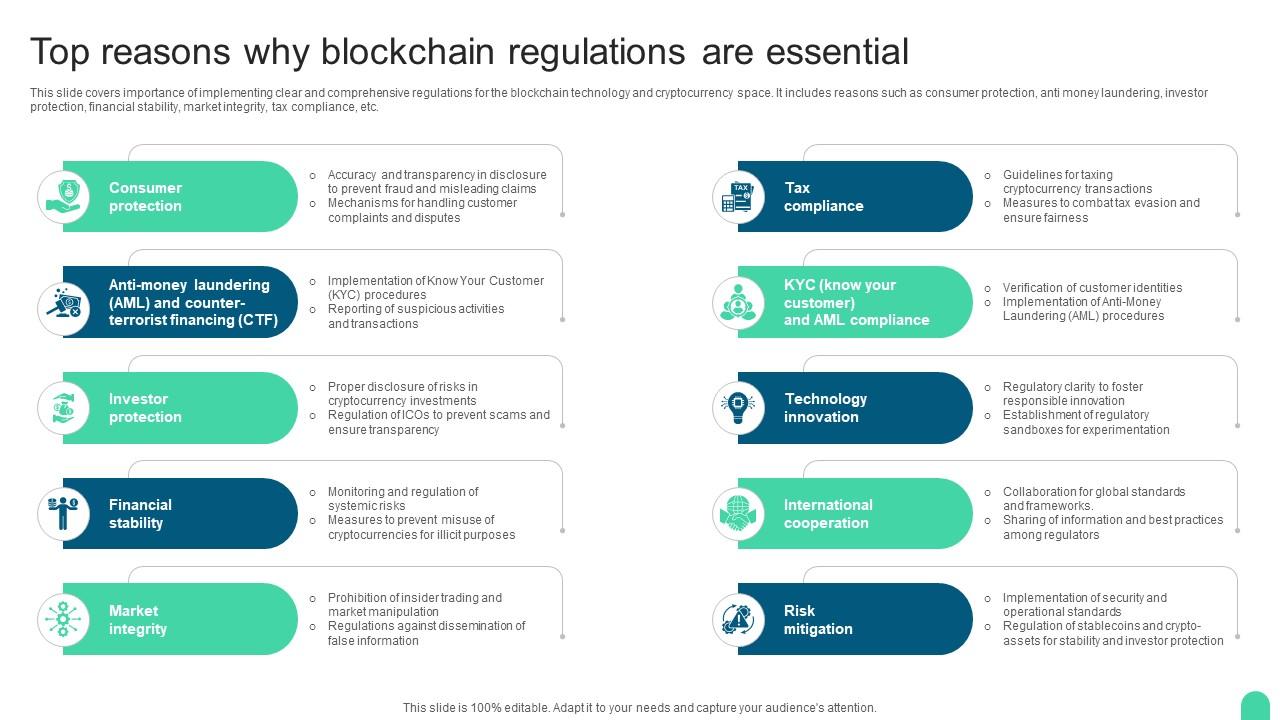

Navigating the complex world of crypto taxes? Look no further! With cross - border transfers, tax - efficient hardware wallet strategies, and reporting stolen/lost coins, it's crucial to stay informed.…